United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM

For

the year ended:

or

For the period ended:

(Exact name of Registrant as specified in its Charter)

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

(Address of Principal Executive Offices)

(Registrant’s Telephone Number, including area code)

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

Indicate

by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐

Indicate

by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during

the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days.

Indicate

by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or emerging growth company:

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. Yes ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). Yes ☐ No ☒

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

The

aggregate market value of the voting and non-voting common stock held by non-affiliates computed by reference to the average bid and

asked price of such common stock on OTCQB of $4.47, as of the last business day of the Registrant’s most recently completed second

fiscal quarter, was approximately $

As of March 19, 2024, there were issued and outstanding shares of the registrant’s common stock.

Documents incorporated by reference: None.

QSAM Biosciences, Inc.

Index

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, contain financial and operating projections or state other forward-looking information. Our ability to predict results or the actual effect of future events, actions, plans or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could have a material adverse effect on our forward-looking statements and upon our business, results of operations, financial condition, funds derived from operations, cash available for dividends, cash flows, liquidity and prospects include, but are not limited to, the factors referenced in this document, including those set forth below:

● |

our failure to close our merger agreement with Telix Pharmaceuticals Limited announced in the first quarter of 2024; | |

| ● | our lack of an operating history; | |

| ● | the net losses that we expect to incur as we develop our business; | |

| ● | obtaining FDA or other regulatory approvals or clearances for our technology; | |

| ● | implementing and achieving successful outcomes for clinical trials of our products; | |

| ● | convincing physicians, hospitals and patients of the benefits of our technology and to convert from current technologies and standards of care; | |

| ● | the ability of users of our products (when and as developed) to obtain third-party reimbursement; | |

| ● | any failure to comply with rigorous FDA and other government regulations; and | |

| ● | securing, maintaining and defending patent or other intellectual property protections for our technology. |

When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this document. Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this document. The matters summarized below and elsewhere in this document could cause our actual results and performance to differ materially from those set forth or anticipated in forward-looking statements. Accordingly, we cannot guarantee future results or performance. Furthermore, except as required by law, we are under no duty to, and we do not intend to, update any of our forward-looking statements after the date of this document, whether as a result of new information, future events or otherwise.

MARKET DATA

Certain market and industry data included in this document is derived from information provided by third-party market research firms, or third-party financial or analytics firms that we believe to be reliable. Market estimates are calculated by using independent industry publications, government publications and third-party forecasts in conjunction with our assumptions about our markets. We have not independently verified such third-party information. The market data used in this document involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and are subject to change based on various factors, including those discussed below and set forth in the “Risk Factors” section of this document. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us. Certain data are also based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Statements as to our market position are based on market data currently available to us. While we are not aware of any misstatements regarding the industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this document. Similarly, we believe our internal research is reliable, even though such research has not been verified by any independent sources.

| 3 |

PART I

ITEM 1. BUSINESS

In this Annual Report, references to the “Company,” “we,” “our,” “us” and words of similar import refer to QSAM Biosciences, Inc., the filer, a Delaware corporation. References to “QSAM” or the “Subsidiary” refer to QSAM Therapeutics Inc., a Texas corporation, our wholly-owned subsidiary and operating company.

Overview

We are developing next-generation nuclear medicines for the treatment of cancer. Our technology is Samarium-153 DOTMP, a/k/a CycloSam® (“CycloSam®” or the “QSAM Technology”), a clinical-stage bone targeting radiopharmaceutical. CycloSam® features a patented, low specific activity form of Samarium-153, a beta-emitting radioisotope with a short 46-hour half-life, and the chelating agent DOTMP, which selectively targets sites of high bone mineral turnover and reduces off-site migration of the tumor-killing radiation. We believe improvements in formulation and manufacturing from a prior FDA-approved drug utilizing the same radioisotope (Quadramet®) has resulted in our drug candidate demonstrating significantly less impurities, lower costs and more frequent availability. In early clinical testing, the QSAM Technology is demonstrating meaningful pain palliation effects in patients with metastatic prostate and breast cancer; and in future studies, may demonstrate disease modifying results in primary bone cancer patients, including children and young adults suffering from osteosarcoma.

In August 2021, the Food & Drug Administration (FDA) cleared our Investigational New Drug (IND) application to commence Phase 1 clinical trials for CycloSam® as a treatment for cancer that has metastasized to the bone from the lung, breast, prostate and other areas. We initiated this trial at our first site (Houston, TX) in November 2021 and to date we have dosed five patients.

Also in August 2021, the FDA granted Orphan Drug Designation for the use of CycloSam® to treat a primary bone cancer called osteosarcoma, a devastating disease that mostly affects children and young adults; and in February 2022, the FDA granted Rare Pediatric Disease Designation for the same indication. In May 2020, CycloSam® was also utilized in a Single Patient Investigational New Drug for Emergency Use at the Cleveland Clinic. We believe the study we conducted at the Cleveland Clinic showed promising safety results in connection with a bone marrow ablation procedure, including patient tolerability at high dosages. To date, CycloSam® has completed animal studies in both small and large animals, including treating bone cancer in patient dogs at a university veterinary clinic.

Merger Agreement. On February 7, 2024, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Telix Pharmaceuticals Limited, a public limited company registered under the laws of the Commonwealth of Australia (“Telix”), and certain subsidiaries of Telix established for the purpose of completing a reverse triangular merger with a second forward merger (collectively, the “Merger”). Pursuant to the Merger Agreement, QSAM stockholders will receive (i) $33.1 million in Telix ordinary shares (“Telix Shares”) or cash, less an adjustment amount equal to QSAM’s indebtedness and certain of its payables as of the Merger closing (the “Closing Consideration”), and (ii) contingent value rights (“CVRs”) to receive contingent future payments of up to $90 million in cash or Telix Shares, without interest, upon and subject to the achievement of four clinical and commercial milestones within ten years of closing.

Prior to closing the Merger, QSAM will effect a reverse stock split of its common stock in a ratio between 1:1000 and 1:2000. Each whole share of QSAM common stock outstanding after the reverse split will be entitled to receive Telix Shares and CVRs as in the Merger. Any remaining fractional shares of QSAM common stock resulting from the reverse split will be exchanged for cash and CVRs. As a result of the reverse split and the Merger, all QSAM stockholders will receive, for each share of QSAM common stock held prior to the reverse split, Telix Shares or cash with a value equal to such share of QSAM common stock’s pro rata share of the Closing Consideration and one CVR.

Telix Shares issued to QSAM stockholders will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), but will be issued pursuant to an exemption to the registration requirements thereunder. The Telix Shares will be subject to resale restrictions under Rule 144 of the Securities Act.

QSAM stockholders representing greater than a majority of the total voting stock of the Company have already approved the Merger. Closing, however, is subject to various conditions set forth in the Merger Agreement including, among others, the filing of a definitive information statement pursuant to Regulation 14C of the Securities Exchange Act of 1934, as amended (the “Information Statement”). The Merger and the reverse split cannot be closed until 20 days after the mailing of the Information Statement to QSAM stockholders. Upon the closing of the Merger, the Company will de-list from the OTC Markets and will file a Form 15 to cease reporting under the Securities Exchange Act of 1934, as amended. There is no guarantee that all closing conditions required to close the Merger will be achieved, or that the Merger will close on the terms described herein.

| 4 |

Background of the QSAM Technology

What is CycloSam®. CycloSam® is a targeted, bone seeking radiopharmaceutical that combines the beta-emitting radioisotope Samarium-153 (153Sm) with a chelating agent, DOTMP (1, 4, 7, 10-tetraazacyclododecane-1, 4, 7, 10-tetramethylenephosphonic acid). Samarium-153 is acquired from a nuclear reactor from a third party and the chelating agent is supplied in the form of kits. Chelating agents are organic compounds capable of linking together metal ions to form complex ring-like structures. This combination forms a stable complex which delivers a radioactive dose to sites of rapid bone mineral turnover such as bone cancers and tumors. CycloSam® has a physical half-life of 46 hours (radiation decreases by half in 46 hours) and emits both medium-energy beta particles that produce the therapeutic effect, and gamma photons that make it possible to take images of the skeleton and locate and characterize the size and nature of tumors. The use of radioisotopes to both diagnose and treat disease is called “theranostics” and is a rapidly growing area of medical discovery.

How CycloSam® Works – Mechanism of Action & Administration. CycloSam® utilizes a chelating agent called DOTMP that seeks out bone locations of high mineral turnover, typical in cancer cells and tumor growth. DOTMP is taken up by calcium turnover locations in bones and carries the radioactive “payload” along with it. The radioisotope Samraium-153 emits radiation as it decomposes in the form of beta particles. Approximately 50% of the radioactivity concentrates in bone mineral with a very high lesion-to-normal bone ratio. We believe this provides a radiation dose to the adjacent tumor cells. The absorbed radiation dose produces the presumed therapeutic effect to the tumor, killing the cancer cells or slowing their growth by damaging their DNA. Metastatic bone cancer patients who have been dosed with CycloSam® have also reported material reductions in pain lasting for several months after treatment. Our pre-clinical studies and single patient IND performed at the Cleveland Clinic has demonstrated that the remaining half of the administered activity is rapidly excreted through the kidneys.

Generally, radiation therapy does not immediately kill cancer cells and more than one treatment is expected to eradicate a tumor, dramatically reduce its size, or slow its growth. CycloSam® has a short half-life of 46 hours and is rapidly eliminated from the body. This avoids an undesirable radioactive buildup in healthy tissues and organs when used in multiple treatments, which we believe, is an important feature of CycloSam® over predecessor drugs. CycloSam® has also not demonstrated saturation of the bone sites in animal studies, which supports a multi-dosage treatment regimen.

The final drug product of CycloSam® is prepared from DOTMP kits and 153SmCl in 0.1 N HCl at a nuclear pharmacy local to the patient administration site. The final drug product is then delivered to the physician for use as an intravenous (IV) injection within 72 hours.

How is CycloSam® Made – Method of Manufacturing. CycloSam® uses a patented, low-specific-activity Samarium-153 which is produced in the lower flux region (beryllium reflector) of the nuclear reactor and can be accessed with a pneumatic tube on a daily basis. Once prescribed by radiation oncologists and nuclear medicine physicians, we order the radioisotopes from Missouri University Research Reactor (MURR) or the University of Texas at Austin (NETL) to be sent overnight to an onsite or nearby (to the patient) nuclear pharmacy to be compounded with a DOTMP “cold kit” and delivered to the treating physician for administration.

The DOTMP “cold kit” is patented in the U.S. and other jurisdictions, and was developed by IsoTherapeutics LLC, the inventors of CycloSam®. Although we believe the IsoTherapeutics’ cGMP manufacturing facility has the capacity to manufacture sufficient supply for our initial rollout, and such manufacturing is currently covered under our master services agreement, we plan to secure secondary manufacturing partners for the kits in the future. MURR has been our source of Samarium-153 used in our animal studies, our Single Patient IND for Emergency Use at the Cleveland Clinic, and for part of our current clinical trials. We also now use NETL for the supply of irradiated Samarium-153, especially as needed to dose patients at our Houston, TX clinical trial site. We plan to qualify additional suppliers of both the raw non-irradiated Samarium, and the irradiation of these materials, as part of our supply chain and general business risk diversification strategy.

| 5 |

What are CycloSam®’s anticipated competitive advantages. We believe CycloSam® has competitive advantages over current radiopharmaceutical offerings in the marketplace. Such potential competitive advantages include:

| ● | CycloSam®’s radioisotope, Samarium-153, emits beta particles that travel farther than alpha particles with what we believe is sufficient energy to slow the growth or decrease the size of target cancer cells. We believe beta particles penetrate bone matter deeper than the alpha emitting radiopharmaceuticals currently in the marketplace and may be more effective in treating tumors that form in or metastasize to bones, as well as the often debilitating pain that results from bone metastasis. | |

| ● | CycloSam®’s delivery agent, DOTMP, compared to other chelating agents such as EDTMP used in Quadramet®, has shown in animal and other pre-clinical testing to have a high bone binding affinity allowing for the maximum delivery of the radioactive “payload” adjacent to the tumor without saturation of the bone, as observed from our pre-clinical trials. | |

| ● | Our method of manufacturing Samarium-153 compared to Quadramet®, has shown in our pharmacopeial limits studies to produce a 30-fold reduction in levels of the long-lived radioactive impurity Europium-154. We believe this may mitigate toxicity issues with the patient. | |

| ● | Our initial studies show CycloSam® has fewer toxicities and a short 46-hour half-life that may allow for more frequent and repeated dosing of our radiopharmaceutical. |

The competitive advantages we believe to be important to CycloSam® are based on pre-clinical animal and other studies including our single patient IND at the Cleveland Clinic and the initial patients dosed in our Phase 1 safety trial. We cannot be sure that our technology will perform similarly in future clinical trials. Failure to achieve these competitive advantages could negatively affect our ability to achieve FDA approval as a new drug, or our ability to market CycloSam®.

License Agreement and Intellectual Property

License Agreement. The Company, through its wholly-owned subsidiary QSAM Therapeutics, entered into an exclusive worldwide Patent and Technology License Agreement and Trademark Assignment (the “License Agreement”) with IGL Pharma, Inc. (“IGL”) on April 20, 2020 with respect to the innovative work of Jim Simon, PhD and R. Keith Frank, PhD, at IsoTherapeutics on Samarium-153 DOTMP. IGL is an affiliated company with IsoTherapeutics. Until January 2024, our Executive Chairman also served as President of IGL. We amended the License Agreement on November 24, 2021, and then again on February 2, 2024 (the “Second Amendment”).

Our License Agreement with IGL, as modified in the first amendment in 2021, is for 20 years or until the expiration of the multiple patents covered under the license and requires multiple milestone-based payments including: up to $410,000 as CycloSam® advances through Phase 3 of clinical trials, and $2 million upon commercialization. IGL has also received 12,500 shares of the Company as additional compensation. Upon commercialization, IGL will receive an on-going royalty equal to 4.5% of Net Sales, as defined in the License Agreement, and 5% of any consideration we receive pursuant to a sublicense, sale of the asset, or sale of QSAM Therapeutics (the “IGL License Fee”). We will also pay for ongoing patent filing and maintenance fees, and we have certain requirements to defend the patents against infringement claims. The parties have agreed to mutual indemnification. Pursuant to the Second Amendment, which was entered into as a condition to the execution of the Merger Agreement, the parties: (i) made modifications to sublicense fees, royalties and other amounts payable to IGL; (ii) made modifications to the definitions of “Commercially Reasonable Efforts,” “Products” and “Patents” described in the License Agreement; and (iii) added an additional payment to IGL of $100,000, payable half upon the execution of the Second Amendment and the balance upon the closing of the Merger. The Second Amendment will only become effective upon the closing of the Merger, and shall become null and void if the closing does not occur.

| 6 |

Either party may terminate the License Agreement 30 days after notice in the event of an uncured breach, or immediately in the case of bankruptcy or insolvency of the other party. QSAM Therapeutics may terminate for any reason upon 30 days’ notice. In the case IGL terminates due to an uncured breach, IGL will repay to us 25% of our direct clinical costs to assume ownership of data and other information gained in that process.

In connection with the License Agreement, QSAM Therapeutics signed a two-year Consulting and Confidentiality Agreement (the “Consulting Agreement”) with IGL, which provided IGL with payments of $8,500 per month that continued through April 2022. We now contract directly with IsoTherapeutics for monthly consulting services at $8,500 per month under our Master Services Agreement. Pursuant to this arrangement, IsoTherapeutics provides us with additional consulting and advisory services from the technology’s founders to assist in the clinical development of CycloSam®. Until January 2024, our Executive Chairman served as President of IGL, and received a $500 per month fee from IGL.

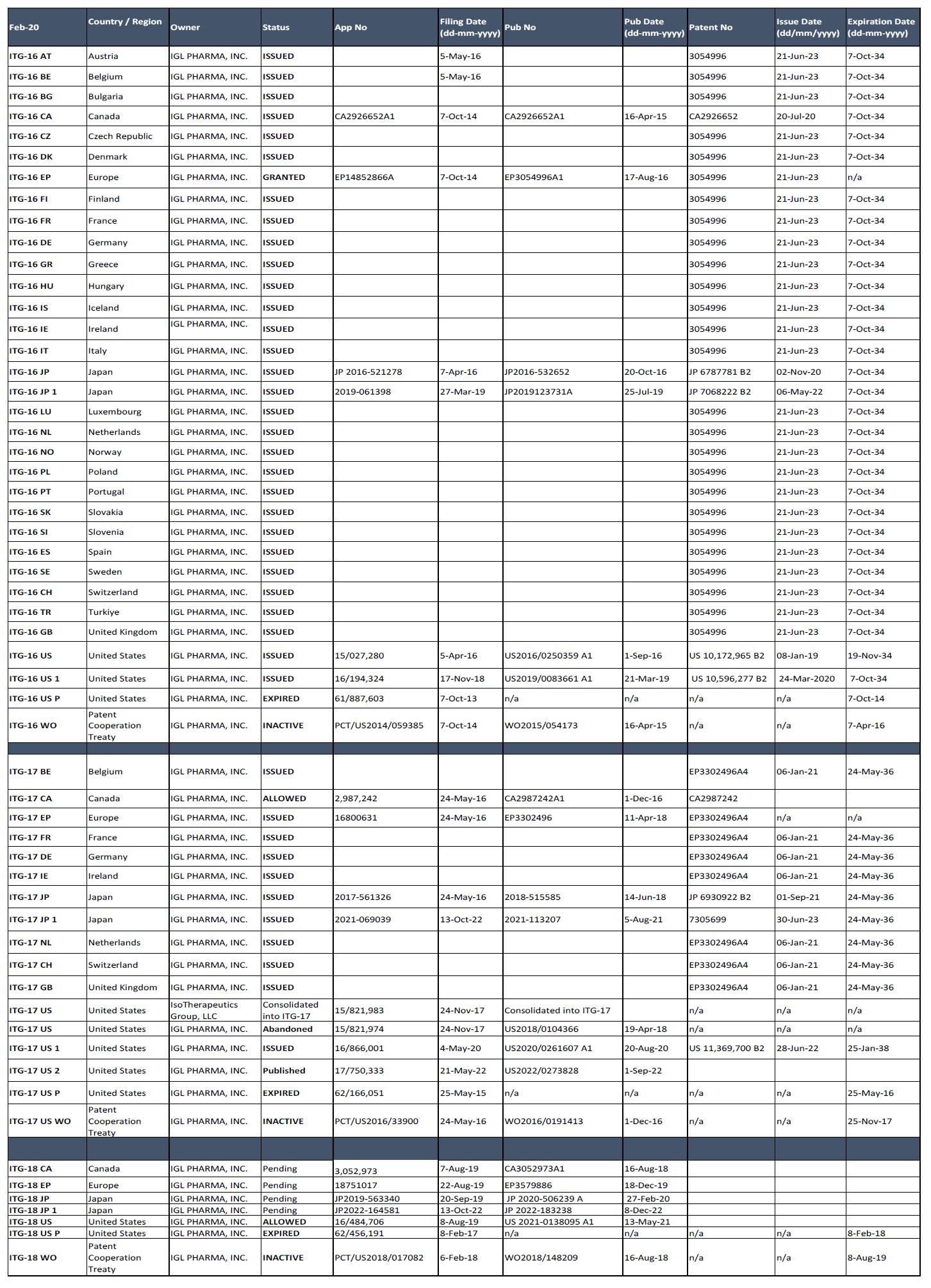

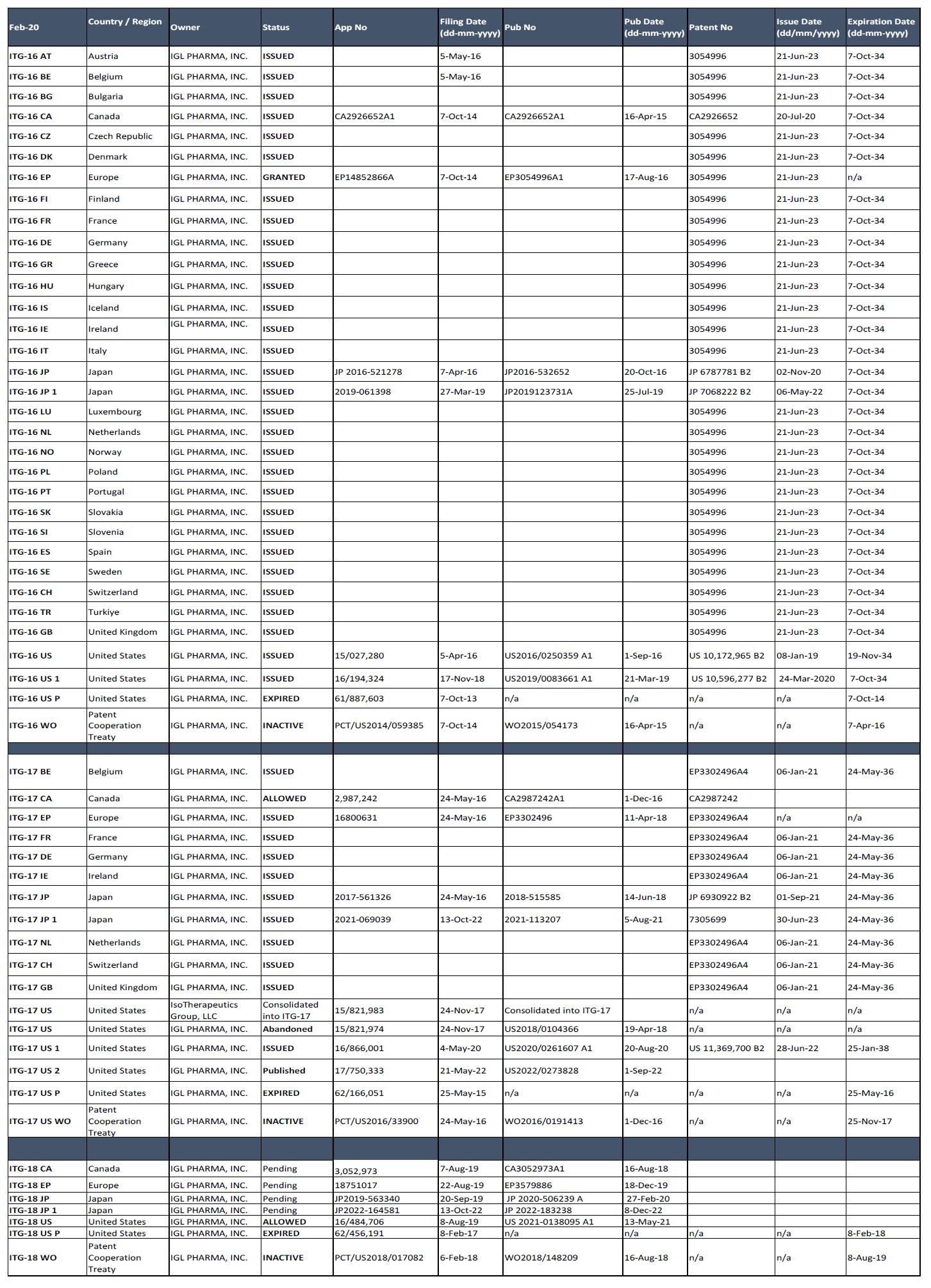

Patents. Pursuant to the License Agreement, our IP estate includes 14 total patents issued and pending across three distinct patent families that we believe provide protection for the use of CycloSam® as a radiopharmaceutical in the U.S. and internationally. Under the License Agreement, the Company holds multiple issued, allowed or granted patents in the US, Japan, Canada, and Europe (which have subsequently been granted in approximately 22 countries in Europe). The balance of these patent applications are pending. Notably, the patents cover the use of low-specific activity Samarium-153, allowing for daily supply of the highly toxicity-reduced formulation of the isotope, which we believe is the key to allowing for multi-dose regimens of CycloSam® that could have a positive therapeutic effect. Also, the CycloSam® kit that will be commercialized is protected by the patent estate that broadly protects DOTMP kit formulations for radioisotopes, potentially allowing for efficient distribution of the product and widespread use. Finally, methods relating to repeat dosing regimens for therapeutic radiopharmaceutical agents, which suggest increased efficacy based on prior research, is also covered under patent applications. Taken together, management believes that the patent family provides for a significant barrier to entry for a competitor as it is expected to prevent a generic product from being developed; however, we cannot guarantee that a competitor will not or cannot challenge our patents or otherwise circumvent our patents, or that we would have the resources to defend any patent infringement.

A list of our patents and status of prosecution is included in the following table:

| 7 |

Trademark. Pursuant to the License Agreement, the Company also has the right to use the registered trademark “CycloSam®” for the marketing and sale of the drug candidate. Pursuant to the Second Amendment, the trademark will be formally assigned to QSAM upon closing of the Merger.

Competition

The biotechnology and pharmaceutical industries are characterized by the rapid evolution of technologies and understanding of disease etiology, a strong emphasis on intellectual property and intense competition. We face substantial potential competition from many different sources, including major pharmaceutical, specialty pharmaceutical and biotechnology companies, academic research institutions, governmental agencies and public and private research institutions.

In addition to the current methods of care for cancer patients, the field of radiopharmaceuticals is deeply studied, and many parties are pursuing commercial and academic clinical trials. Early results from these trials have fueled continued interest in radiopharmaceuticals, which are pursued by several biotechnology companies as well as by large pharmaceutical companies.

We consider our competitors to be other companies developing targeted radiopharmaceuticals for the treatment of cancer. There are several companies developing targeted alpha-based radiopharmaceuticals for the treatment of cancer, including Bayer AG, or Bayer, Actinium Pharmaceuticals, Inc., RadioMedix, Inc, Orano Med, Telix, Fusion Pharmaceuticals Inc., and RayzeBio, Inc. These companies are targeting a wide range of solid and hematologic malignancies using various alpha emitting isotopes, including Radium-223, Actinium-225 and Thorium-227. The first approved alpha particle-based therapy is Bayer’s Xofigo, a salt of radium that is not currently attached to a targeting molecule, but naturally localizes to regions where cancer cells are infiltrating bone. Xofigo was approved in the United States by the FDA in 2013 for the treatment of bone metastases associated with prostate cancer.

There are several companies with approved or late clinical stage beta-based radiopharmaceuticals, including Novartis AG, Telix, and POINT Biopharma Global. Novartis received FDA approval for Pluvicto in 2022, a radiopharmaceutical medication used for the treatment of prostate-specific membrane antigen-positive metastatic castration-resistant prostate cancer, and, in 2023, generated approximately $980 million in worldwide sales according to recent company filings. Pluvicto uses the beta-emitter Lutetium-177. Another competitive company, POINT Biopharma, has two indications using beta-emitting particles in Phase 3 trials, and which were recently licensed by Lantheus. The beta emitting isotopes used by these companies include Iodine-131, Lutetium-177, Strontium-89 and Yttrium-90. There are other beta particle-based radiopharmaceuticals in various stages of clinical development by companies including Ipsen S.A., Y-mAbs Therapeutics, Inc. and Clovis Oncology, Inc.

Many of our current or potential competitors, either alone or with their collaboration partners, have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals and marketing approved products than we do. Mergers and acquisitions in the pharmaceutical and biotechnology industries may result in even more resources being concentrated among a smaller number of our competitors. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and patient enrollment in clinical trials, as well as in acquiring technologies and materials complementary to, or necessary for, our programs.

We could see a reduction or elimination in our commercial opportunity if our competitors develop and commercialize drugs that are safer, more effective, have fewer or less severe side effects, are more convenient to administer, are less expensive or with a more favorable label than our product candidates. Our competitors also may obtain FDA or other regulatory approval for their drugs more rapidly than we may obtain approval for ours, which could result in our competitors establishing a strong market position before we are able to enter the market. The key competitive factors affecting the success of our product candidate, if approved, are likely to be their efficacy, safety, convenience, price, and the availability of reimbursement from government and other third-party payors.

| 8 |

Radiopharmaceutical Market

The global radiopharmaceuticals market size is projected to reach $13.67 billion by 2032, registering a CAGR of 10.2% during the forecast period 2023 to 2032, according to a November 2023 report from Precedence Research, a global provider of market insights. North America dominates the global radiopharmaceuticals market, which is attributed to the rising prevalence of chronic illnesses, extensive research and development initiatives, a supportive regulatory landscape, and the presence of leading pharmaceutical and radiopharmaceutical enterprises. Based on type, the radiopharmaceuticals market is bifurcated into diagnostic nuclear medicine and therapeutic nuclear medicine. The diagnostic nuclear medicine segment is holding a larger share of the market and is anticipated to register a higher CAGR during 2021–2028. By application, the market is segmented into oncology, cardiology, neurology, and others, with the oncology segment holding the largest market share in 2022.

Overall, we believe that the recent technological developments in radiopharmaceuticals, including promising new alpha-emitting candidates, will continue to provide supportive tailwinds to this sector. As a result, management believes that it is well positioned to capitalize on these future opportunities.

History of CycloSam® development and past studies and trials

The Company has an exclusive worldwide patent and technology License Agreement for CycloSam®. The QSAM Technology was developed at IsoTherapeutics Group, LLC (“IsoTherapeutics”) by its founders Jim Simone, PhD and R. Keith Frank, PhD (the “Inventors”). IsoTherapeutics subsequently transferred their technology to IGL Pharma, Inc., an affiliated entity and the Company’s current licensor. The Inventors also developed one of the first commercial radiopharmaceuticals on the market, Quadramet®, approved by the FDA in 1997 for pain palliation. Drs. Simone and Frank each have over 30 years of experience in radiopharmaceuticals, publishing more than 100 papers and authoring over 60 patents in the field. The Inventors spent much of their careers at Dow Chemical Company prior to divestiture of its radiopharmaceutical business. According to the Inventors, CycloSam® was developed to address the shortcomings of other radiopharmaceuticals, including Quadramet, such as toxicity, saturation effects, long-lived impurities, and supply-chain complexities.

Prior generation Quadramet vs Improvements in CycloSam®. CycloSam® is a second-generation bone-seeking radiopharmaceutical based on Quadramet. Although Quadramet was clinically proven to be effective for pain palliation associated with metastatic bone cancer, the toxicity of the drug made repeat doses undesirable and manufacturing complexities made daily availability highly challenging. Therefore, Quadramet’s use was always limited to pain control, not tumor reduction, elimination or disease modification. The loose binding affinity of Quadramet’s chelating agent, EDTMP, means the ratio of chelant to Samarium-153 is extremely high (~300:1). The resulting problem of bone saturation prohibits usage of Quadramet in high doses required for treatment of bone cancer or bone marrow ablation. Additionally, high levels of impurities from the Samarium-153 production, namely Europium-154, made repeated dosing of Quadramet undesirable. Lastly, Quadramet faced supply-chain and distribution limitations because the Samarium-153 it uses could only be accessed from the reactor once per week. We believe that because of these challenges, Quadramet demonstrated limited market success, and to our knowledge, was recently discontinued by its manufacturer and distributor. We believe CycloSam® overcomes these inherent limitations of Quadramet in terms of toxicity, usage, and availability.

The Vienna Protocol – Precedent of Efficacy. In August 2011, Dr. Helmut Sinzinger published a study in the Quarterly Journal of Nuclear Medicine and Molecular Imaging, which demonstrated that despite the described limitations of Samarium-153 EDTMP (Quadramet®), it could still be used to effectively treat bone metastasis.

The Vienna Protocol, as it was labeled, was based on a 550 patient study developed by Dr. Sinzinger to deliver therapeutic doses of Quadramet® on a periodic low dose basis balancing hematological toxicity and europium buildup with clinical results. The specific regimen used very low doses of the predecessor drug on an outpatient basis. The treatment was administered at three month intervals during the first year, followed by another five treatments at six month intervals, then five therapies at nine month intervals, and then annually indefinitely. The dosing schedule was driven by hematological concerns and constant monitoring was required.

During Dr. Sinzinger’s trials, a wide range of positive clinical responses were seen including arrested tumor growth and even regression of the cancer in the bone. Some patients were treated for over five years exhibiting significant clinical response. While effective, this regimen required significant time and safety precautions on the part of both the physician and patient both of which were considered overly burdensome. Although this study was well published and the efficacy results were promising, wide clinical adoption did not occur due to the overall effort that was required to deliver a true therapeutic dose while avoiding the toxicity issues. Quadramet was never approved by the FDA for the treatment of bone cancer, but rather, just for pain management associated with the disease.

| 9 |

Improvements of CycloSam® over Predecessor Drug

CycloSam® is a new, advanced generation Samarium-153 drug with a dramatically different clinical profile than Quadramet®. By producing the Samarium-153 in a different part of the nuclear reactor, the decay by-product Europium has shown in studies to be nearly non-existent, thus eliminating long-term buildup concerns [Source: IsoTherapeutics Group. (2021). Preparation and Stability of CycloSam® Sm-153-DOTMP. (Report No. QSM-1)]. Secondly, the superior binding affinity of the new chelating agent, DOTMP, means more energy can be delivered to the target, thus minimizing off-target concerns. Further, the method of harvesting the patented low specific activity Samarium-153 means it can be accessed on a daily basis, compared to weekly for Quadramet®, at a reduced cost. We believe that all of these clinical and manufacturing improvements were achieved without any reduction in either the tumor killing power of Samarium-153 or its ability to travel deep into the bone tumor.

Potential Market Indications for CycloSam®.

CycloSam’s therapeutic profile and presumed advantages over other radiopharmaceuticals, including Quadramet, translate to several potential key market indications, including treating pain associated with cancer that has metastasized to the bone and certain forms of primary bone cancer, such as osteosarcoma, which mostly affects children and young adults. The following table highlights the prevalences of these diseases in the United States on an annual basis:

| Market | Estimated New Cases Diagnosed Annually (US) | |||

| Bone Metastases (Breast, Prostate, Lung) | 400,000 | |||

| Other Primary Bone Cancers | 2,770 | |||

| Primary Bone Cancer – Osteosarcoma | 1,000 | |||

| Primary Bone Cancer – Ewing’s Sarcoma | 200 | |||

Source: American Cancer Society estimates of new cases reported each year in the United States. Data as of January 2023.

Bone metastases arise in about 5% of all types of cancer, 29% of patients with multiple myeloma (15,000), 16% of lung (37,000), 6% of prostate (48,000) and 7% of breast cancers (70,000). Roughly 70% of patients with bone metastases will experience bone pain, and many are at risk for skeletal-related events including fracture and spinal cord compression. The total annual cost for treatment of metastatic bone disease is approximately $12.7 billion or 17% of the total of $74 billion that was spent on direct medical costs of these cancers [Source: Schulman KL, Kohles J. Economic burden of metastatic bone disease in the U.S. Cancer. 2007 Jun 1;109(11):2334-42. doi: 10.1002/cncr.22678. PMID: 17450591]. In addition to metastatic bone cancers, according to the National Institute of Health SEER, there are approximately 14,000 people living with osteosarcoma in the US at any one time [Source: Damron TA, Ward WG, Stewart A. Osteosarcoma, chondrosarcoma, and Ewing’s sarcoma: National Cancer Data Base Report. Clin Orthop Relat Res. 2007 Jun;459:40-7. doi: 10.1097/BLO.0b013e318059b8c9. PMID: 17414166, and National Cancer Institute: Surveilance, E., and End Results Program Cancer Stat Facts: Bone and Joint Cancer, <https://seer.cancer.gov/statfacts/html/bones.html> (2020)] and their cost of care is estimated to exceed $100,000 per patient [Source: American Cancer Society. Key Statistics About Bone Cancer].

Metastatic bone cancer is currently incurable, and therefore palliation and arrest or deceleration of the progress of disease are important near-term goals. Quadramet® (Samarium-153-EDTP) and MetastronTM (89Sr chloride) were approved by the FDA for pain palliation resulting from osteoblastic bone metastases, but their widespread acceptance and use is hampered by concern about the perceived risk of myelosuppression when administered concurrently with chemotherapy. Xofigo, an alpha particle emitter, was approved in May 2013 and initially was expected to capture significant market share rapidly; however, certain safety concerns have limited the product’s applicability. Novartis’ Pluvicto, a beta-emitter, was approved by the FDA in late 2022 for the treatment of prostate-specific membrane antigen-positive metastatic castration-resistant prostate cancer. Novartis reported worldwide sales of Pluvicto in 2023 of approximately $980 million according to company filings, and reported in a recent conference that they expect sales to reach $2 billion in the coming years.

| 10 |

Osteosarcoma is the most common childhood and adolescent/young adult (ages 15-39) primary high-grade bone malignancy [Source: Taran SJ, Taran R, Malipatil NB. Pediatric Osteosarcoma: An Updated Review. Indian J Med Paediatr Oncol. 2017;38(1):33-43. doi:10.4103/0971-5851.203513]. Patients can often have metastatic cancer at diagnosis, and metastasis to the lungs is often fatal for these patients. For patients who develop or present with metastatic cancer in this diagnosis, the 5-year survival rate is 66% [Source: Osteosarcoma - Childhood and Adolescence - Statistics.” Cancer.Net, 30 Sept. 2021, https://www.cancer.net/cancer-types/osteosarcoma-childhood-and-adolescence/statistics]. Osteosarcoma standard-of-care usually involves chemotherapy which has substantial negative side effects, or drastic surgeries such as limb salvage or amputation. Osteosarcoma is relatively resistant to External Beam Radiation Therapy (EBRT), and currently approved radiopharmaceutical therapeutics fall short due to myelotoxicity and long-lived radioactive impurities. There is a tremendous unmet need for a better treatment that is more efficacious against pediatric osteosarcoma and better tolerated by patients.

Preclinical and Clinical Studies

Preclinical Studies. Preclinical toxicology studies of CycloSam® in rats and dogs have shown that a single intravenous dose of non-radioactive Samarium-153 DOTMP elicited no significant systemic toxicity. Skeletal uptake has also been studied in rats over a wide range of doses to determine whether CycloSam® displays a similar saturation effect which has been observed in studies of Samarium-153 EDTMP (aka Quadramet). In the rat saturation study, no statistically significant difference was found in uptake as a function of increased dosage of CycloSam®.

In addition to rat and dog toxicological studies, a proof-of-concept study was conducted in ten dogs with spontaneously occurring bone cancer treated with 1-2 mCi/kg of CycloSam®. Treatment was well tolerated with seven dogs treated at a dose of 1 mCi/kg and one dog treated with 2 mCi/kg who did not experience a dose limiting toxicity. One dog treated with 2 mCi/kg and one dog treated with 2.3 mCi/kg experienced grade 4 asymptomatic thrombocytopenia and neutropenia; which refers to a manageable depressed level of platelets and neutrophils in the blood. Results from these preclinical studies suggested CycloSam® has potential as a therapeutic agent in the treatment of primary bone cancer and metastatic bone disease.

Safety/Tox Studies. Non-radioactive CycloSam® has been through a full-scale 14-day, acute toxicological study in both rats and dogs. This study was designed to determine the toxicokinetics of the product at four different dose levels that are higher than expected to be used in the current clinical trials. The studies showed no systemic toxicity in either of the species with a single intravenous administration of CycloSam® (non-radioactive). Some mild to moderate allergic-like responses were seen in dogs at the highest dose, which is much higher than would be expected for clinical use.

Non-clinical testing. Rat and rabbit pharmacology and targeted bone pharmacology studies have been undertaken and published in both patents and in the literature for Samarium-153-DOTMP and their preclinical results demonstrated significant skeletal uptake fractions. We believe these studies suggest CycloSam® has promise as a bone seeking radiopharmaceutical.

Clinical Pharmacology. The majority of non-clinical pharmacology studies with CycloSam® have been done in rats. When administered through the tail vein, much of the Samarium-153-DOTMP binds to the bone; the half-life is 46.3 hours, but the portion of the drug not bound to bone or calcified tissue is completely eliminated through the kidneys within 6 hours of administration. Two additional studies in dogs with osteosarcoma have also elicited promising results, and confirm bone uptake, preliminary safety, and preliminary clinical benefit against bone tumor. Preclinical results demonstrated significant skeletal uptake fractions.

Clinical Studies. We are currently enrolling patients in a Phase 1 multiple center, open label, dose escalation clinical trial intended to determine the maximum tolerated dose of CycloSam® in participants, and also assess early efficacy signals. Participants with bone cancer that has metastasized from the breast, lungs, prostate or other organs, as well as participants with cancer that has originated in the bone such as osteosarcoma and Ewing’s Sarcoma – diseases that mostly affect children and young adults — are eligible subject to the trial’s inclusion and exclusion criteria.

| 11 |

To date, we have completed two of four patient groupings (“cohorts”), with a total of up to 17 participants expected to be enrolled. The completed cohorts are comprised of five participants who received the lowest two dosages of CycloSam® in the study. The total dosage of the active radioisotope Samarium-153 to be received by the third cohort will be twice as high as the second cohort.

Safety data from the first five trial participants in our Phase 1 clinical trial showed no Serious Adverse Events (SAE’s), and no irreversible clinically significant adverse events. Importantly, there was no clinically significant white, red, or platelet blood cell suppression to date, no Grade 3 adverse events, and no irreversible adverse events. Some trial participants also had initial pain relief and reduction from baseline in pain intensity scores using the Visual Analog Scale (VAS) of pain intensity. Additionally, some trial participants had an initial reduction from baseline after treatment in bone tumor size as measured using Response Evaluation Criteria in Solid Tumors (RECIST) criteria in the followed bone tumor. Some trial participants also had an initial reduction in tumor Standard Uptake Values (SUV’s), an imaging measure of bone tumor activity. These results are preliminary and may not be indicative of future results in the trial.

In February 2022, the FDA cleared our amended protocol increasing the age criteria to participants 75 years old from the prior age limitation of 65. This amendment to the enrollment criteria expands the population of potential participants in QSAM’s Phase 1 study evaluating CycloSam® in the treatment of bone cancer.

In 2020, CycloSam® was studied for the first time in humans under a Single Patient Investigational New Drug (IND) for Emergency Use at the Cleveland Clinic. The patient, a 25 year-old male who suffered from myelodysplastic syndrome (MDS) and high-risk osteosarcoma, received a single low dose of 1 mCi/kg of CycloSam® on March 24, 2020 for dosimetry. This was followed seven days later on March 31, 2020 by a single high dose of 32 mCi/kg (1919 mCi) of CycloSam®. No injection site effects were noted at the time of injection. At 48 hours post-injection of the second dose there was no renal toxicity observed. The estimated dose delivered to the skeleton was 40 Gy with bone lesion uptake of 60 Gy. The abbreviation Gy stands for “gray”, which is a measurement of radiation reaching the target. In this instance, a 45 Gy is considered required to deliver the radiation to the target, and therefore, 60 Gy was considered very good. The patient received an allogeneic stem cell transfusion two weeks following high dose injection of Samarium-153 DOTMP; however, the stem cell transplant failed to fully engraft. The patient, who was terminally ill prior to the treatment, passed away on August 18, 2020, a month after bone marrow ablation and after additional procedures not using a radiopharmaceutical were performed, from complications of an infection unrelated to the infusion of CycloSam® according to the investigator.

The investigator concluded that high-dose CycloSam® can be given safely with no apparent renal toxicity and no unexpected adverse events attributable to Samarium-153 DOTMP. Skeletal targeting with sparing of other tissues was observed after the high dose. This was only a single patient human clinical trial, and the patient did not survive long enough for full observation, so additional safety and efficacy clinical trial data will have to be developed.

Contracted Research Organization. In January 2020, our licensor, IGL Pharma, entered into a Master Services Agreement (MSA) with a full-service Contract Research Organization (CRO) with over a 30 year history of service to pharmaceutical and biotechnology clients. The MSA was amended in February 2021 to add QSAM as a party and includes a fixed monthly retainer for regulatory and clinical trial consulting services as well as specific work orders for clinical trial execution services. The CRO has a full-time staff of project managers, statisticians, physicians, nurses and other regulatory and operational personnel to support our FDA interactions, filings and preclinical and clinical trial activities. Specifically, the CRO provides clinical trial management services, clinical study monitoring services, medical coding services, electronic data capture services, data management services, medical monitoring services, safety reporting and medical writing services.

Government Regulation and Product Approval

Clinical trials, the drug approval process, and the marketing of drugs are intensively regulated in the United States and in all major foreign countries. In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act (“FDCA”), and related regulations. Drugs are also subject to other federal, state, and local statutes and regulations. Failure to comply with the applicable U.S. regulatory requirements at any time during the product development process, approval process or after approval may subject an applicant to administrative or judicial sanctions. These sanctions could include the imposition by the FDA Institutional Review Board (“IRB”) of a clinical hold on trials, the FDA’s refusal to approve pending applications or supplements, withdrawal of an approval, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties or criminal prosecution. Any agency or judicial enforcement action could have a material adverse effect on us.

| 12 |

The FDA and comparable regulatory agencies in state and local jurisdictions and in foreign countries impose substantial requirements upon the clinical development, manufacture and marketing of biopharmaceutical products. These agencies and other federal, state, and local entities regulate research and development activities and the testing, manufacture, quality control, safety, effectiveness, labeling, storage, distribution, record keeping, approval, advertising, and promotion of product we develop in the future.

The FDCA and/or FDA’s policies may change, and additional government regulations may be enacted that could prevent or delay regulatory approval of any candidate drug product or approval of new disease indications or label changes. We cannot predict the likelihood, nature or extent of adverse governmental regulation that might arise from future legislative or administrative action, either in the United States or abroad.

Marketing Approval: The process required by the FDA before new drugs may be marketed in the United States generally involves the following:

| ● | nonclinical laboratory and animal tests; | |

| ● | chemistry, manufacturing, and control testing (CMC), validation and documentation of all synthesis, preparation and production processes for all kit ingredients and finished products; | |

| ● | submission of an Investigational New Drug (IND) application, which must become effective before clinical trials may begin; | |

| ● | adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed drug for its intended use or uses; | |

| ● | pre-approval inspection of manufacturing facilities and clinical trial sites; and | |

| ● | FDA approval of a New Drug Application (NDA) which must occur before a drug can be marketed or sold. |

The testing and approval process requires substantial time and financial resources, and we cannot be certain that any approvals will be granted on a timely basis if at all.

We will need to successfully complete additional clinical trials in order to be in a position to submit an NDA to the FDA. Future trials may not begin or be completed on schedule, if at all. Trials can be delayed for a variety of reasons, including delays in:

| ● | obtaining regulatory approval to commence a study; | |

| ● | reaching agreement with third-party clinical trial sites and vendors and their subsequent performance in conducting accurate and reliable studies on a timely basis; | |

| ● | obtaining institutional review board approval to conduct a study at a prospective site; | |

| ● | recruiting subjects to participate in a study; and | |

| ● | supply of the drug. |

We must reach an agreement with the FDA on the proposed protocols for our future clinical trials, post-market safety monitoring, and on a Pediatric Development Plan in the United States. All new drugs now require the presentation to the FDA after Phase II clinical trials have ended of a Pediatric Development Plan outlining the strategy and steps to be taken by us to study CycloSam® in children as appropriate. A separate submission to the FDA must be made for each successive clinical trial to be conducted during product development. Further, an independent IRB for each site proposing to conduct the clinical trial must review and approve the plan for any clinical trial before it commences at that site. Informed consent must also be obtained from each study subject. Regulatory authorities, an IRB, a data safety monitoring board, or the sponsor may suspend or terminate a clinical trial at any time on various grounds, including a finding that the participants are being exposed to an unacceptable health risk. Such risks may include unexpected or serious adverse events, or increased severity or occurrence rate of known potential adverse events.

| 13 |

FDA Post-Approval Requirements: Any products manufactured or distributed by us pursuant to FDA approvals are subject to continuing regulation by the FDA, including requirements for record-keeping and reporting of adverse experiences with the drug and/or additional post-market clinical trials. Drug manufacturers are required to register their facilities with the FDA and certain state agencies and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with cGMPs, which impose certain quality processes, manufacturing controls, and documentation requirements upon us and our third-party manufacturers in order to ensure that the product is safe, has the identity and strength, and meets the quality and purity characteristics that it purports to have. Under the federal Prescription Drug Marketing Act, the sampling and distribution and tracking of drugs is regulated. It is designed to discourage the sale of counterfeit, adulterated, misbranded, subpotent, and expired prescription drugs. Certain states also impose requirements on manufacturers and distributors to establish the pedigree of product in the chain of distribution, including some states that require manufacturers and others to adopt new technology capable of tracking and tracing product as it moves through the distribution chain. We cannot be certain that we or our present or future suppliers will be able to comply with the cGMP and other FDA regulatory requirements. If our present or future suppliers are not able to comply with these requirements, the FDA may halt our clinical trials, fail to approve any NDA or other application, require us to recall a drug from distribution, shut down manufacturing operations or withdraw approval of the NDA for that drug. Noncompliance with cGMP or other requirements can result in issuance of warning letters, civil and criminal penalties, seizures, and injunctive action.

Labeling, Marketing and Promotion: The FDA closely regulates the labeling, marketing, and promotion of drugs. While doctors are free to prescribe any drug approved by the FDA for any use, a company can only make claims relating to the safety and efficacy of a drug that are consistent with FDA approval and may only actively market a drug only for the particular use and treatment approved by the FDA. In addition, any claims we make for our products in advertising or promotion must be appropriately balanced with important safety information and otherwise be adequately substantiated. Failure to comply with these requirements can result in adverse publicity, warning letters, corrective advertising, injunctions, and potential civil and criminal penalties. Government regulators recently have increased their scrutiny of the promotion and marketing of drugs.

Pediatric Research Equity Act: The Pediatric Research Equity Act (“PREA”) amended the FDCA to authorize the FDA to require certain research into drugs used in pediatric patients. The intent of the PREA is to compel sponsors whose drugs have pediatric applicability to study those drugs in pediatric populations, rather than ignoring pediatric indications for adult indications that could be more economically desirable. The Secretary of Health and Human Services may defer or waive these requirements under specified circumstances. The FDA may decide that an NDA will be approved only following completion of additional pediatric studies.

Anti-Kickback and False Claims Laws: In the United States, the research, manufacturing, distribution, sale and promotion of drug products and medical devices are potentially subject to regulation by various federal, state and local authorities in addition to the FDA, including the Centers for Medicare & Medicaid Services, other divisions of the U.S. Department of Health and Human Services (e.g., the Office of Inspector General), the U.S. Department of Justice, state Attorneys General, and other state and local government agencies. For example, sales, marketing, and scientific/educational grant programs must comply with the Anti-Kickback Statute, the False Claims Act, as amended, the privacy regulations promulgated under HIPAA, and similar state laws. Pricing and rebate programs must comply with the Medicaid Drug Rebate Program requirements of the Omnibus Budget Reconciliation Act of 1990, as amended, and the Veterans Health Care Act of 1992, as amended. If products are made available to authorized users of the Federal Supply Schedule of the General Services Administration, additional laws and requirements apply. All of these activities are also potentially subject to federal and state consumer protection and unfair competition laws.

In the United States, we are subject to complex laws and regulations pertaining to healthcare “fraud and abuse,” including, but not limited to, the Anti-Kickback Statute, the federal False Claims Act, and other state and federal laws and regulations. The Anti-Kickback Statute makes it illegal for any person, including a prescription drug manufacturer (or a party acting on its behalf) to knowingly and willfully solicit, receive, offer, or pay any remuneration that is intended to induce the referral of business, including the purchase, order, or prescription of a particular drug, for which payment may be made under a federal healthcare program, such as Medicare or Medicaid.

| 14 |

The federal civil False Claims Act prohibits, among other things, any person or entity from knowingly presenting, or causing to be presented, a false or fraudulent claim for payment to or approval by the federal government or knowingly making, using or causing to be made or used a false record or statement material to a false or fraudulent claim to the federal government. A claim includes “any request or demand” for money or property presented to the U.S. government. Violations of the False Claims Act can result in very significant monetary penalties and treble damages. The federal government is using the False Claims Act, and the accompanying threat of significant liability, in its investigation and prosecution of pharmaceutical companies throughout the country, for example, in connection with the promotion of products for unapproved uses and other sales and marketing practices. The government has obtained multi-million and multi-billion-dollar settlements under the False Claims Act in addition to individual criminal convictions under applicable criminal statutes. In addition, the federal civil monetary penalties statute imposes penalties against any person or entity that, among other things, is determined to have presented or caused to be presented a claim to a federal health program that the person knows or should know is for an item or service that was not provided as claimed or is false or fraudulent. Given the significant size of actual and potential settlements, it is expected that the government will continue to devote substantial resources to investigating healthcare providers’ and manufacturers’ compliance with applicable fraud and abuse laws. The federal Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), also created new federal criminal statutes that prohibit knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program, including private third-party payors and knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services. Similar to the Anti-Kickback Statute a person or entity does not need to have actual knowledge of these statutes or specific intent to violate them in order to have committed a violation.

There are also an increasing number of state laws that require manufacturers to make reports to states on pricing and marketing information. Many of these laws contain ambiguities as to what is required to comply with the laws. In addition, a similar federal requirement Section 6002 of the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act (the “Affordable Care Act”) commonly referred to as the “Physician Payments Sunshine Act” requires manufacturers to track and report to the federal government certain payments and “transfers of value” made to physicians and teaching hospitals, as well as ownership and investment interests held by physicians and their immediate family members, made in the previous calendar year. There are a number of states that have various types of reporting requirements as well. These laws may affect our sales, marketing, and other promotional activities by imposing administrative and compliance burdens on us. In addition, given the lack of clarity with respect to these laws and their implementation, our reporting actions could be subject to the penalty provisions of the pertinent state, and soon federal, authorities.

Patient Protection and Affordable Health Care Act: Historically in the United States, policy makers have attempted several healthcare reforms regarding the healthcare system that could expand access to healthcare, improve quality of healthcare, contain healthcare costs, prevent or delay approval of product candidates, restrict or regulate post-approval activities, and affect the profitable sale of drugs.

In the United States, the pharmaceutical industry has been a particular focus of these efforts and has been significantly affected by major legislative initiatives. In March 2010, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act, collectively referred to as the ACA, was passed, which substantially changed the way healthcare is financed by both governmental and private insurers, and significantly affected the pharmaceutical industry. Since its enactment, there have been judicial and political challenges to certain aspects of the ACA. Most recently on June 17, 2021, the U.S. Supreme Court dismissed a judicial challenge to the ACA brought by several states without specifically ruling on the constitutionality of the ACA. Prior to the Supreme Court’s decision, President Biden issued an executive order to initiate a special enrollment period from February 15, 2021 through August 15, 2021 for purposes of obtaining health insurance coverage through the ACA marketplace. The executive order also instructed certain governmental agencies to review and reconsider their existing policies and rules that limit access to healthcare, including among others, reexamining Medicaid demonstration projects and waiver programs that include work requirements, and policies that create unnecessary barriers to obtaining access to health insurance coverage through Medicaid or the ACA. It is unclear how the healthcare reform measures of the Biden administration or other efforts, if any, to challenge, repeal or replace the ACA will impact the ACA.

Congress and the Biden administration have generally indicated that they will continue to seek new legislative and/or administrative measures to control drug costs and improve access. Individual states in the United States have also become increasingly active in implementing regulations designed to control pharmaceutical product pricing, including price or patient reimbursement constraints, discounts, restrictions on certain product access and marketing cost disclosure and transparency measures, and, in some cases, designed to encourage importation from other countries and bulk purchasing. In addition, regional healthcare authorities and individual hospitals are increasingly using bidding procedures to determine which drugs and suppliers will be included in their healthcare programs. Furthermore, there has been increased interest by third party payors and governmental authorities in reference pricing systems and publication of discounts and list prices.

| 15 |

Other Regulations: We are also subject to numerous federal, state and local laws relating to such matters as safe working conditions, manufacturing practices, environmental protection, fire hazard control, and disposal of hazardous or potentially hazardous substances. We may incur significant costs to comply with such laws and regulations now or in the future.

The CycloSam® radioactive product is regulated by the federal Nuclear Regulatory Commission (NRC), and also by similar state regulatory agencies. The handling, packaging, shipping, transportation, and disposal of radioactive materials is highly regulated, and those regulations can change, and the Company would have to comply with all requirements, which could be costly. Additionally, if overnight delivery failures occur, the radioactive compounds cannot be used, and that can result in substantial increased costs and liabilities. The disposal of radioactive materials is also regulated by the Environmental Protection Agency (EPA), and also by similar state regulatory agencies and the Company would have to comply with all of those requirements, which could also be costly.

Radioactive waste from the medical sector is an environmental concern from a global perspective. However, most studies have concluded that radioactive material from the medical sector does not present a significant long term waste management problem when compared to wastes generated from nuclear fuel cycle operations. This is primarily due to the characteristics of biomedical waste, such as its short half-life and low radiotoxicity. For instance, Samarium-153 has a half-life of approximately 46 hours. Biomedical waste also typically contains low energy emitters, such as beta and gamma isotopes, and is generally of low total and specific activity. Further considerations are the volumes of this waste and any other hazardous properties associated with the waste such as biological and chemical risks.

Regardless of the relatively low risks in the preparation, use and disposal of medical isotopes, entities that handle such materials should implement an effective program for biomedical radioactive waste management based on the principles of waste prevention and minimization, while providing for the protection of personnel and the environment, consistent with the requirements of applicable regulatory authorities. This assessment should include an analysis of the total radionuclide inventory and pattern of use, waste types and amounts generated and the potential routes for disposal.

We seek to assure that the nuclear reactor facilities that produce our Samarium-153, as well as the nuclear pharmacies that prepare doses for treatment, have proper and effective waste management procedures in place applicable to the risks presented by the actual material. Further, doctors and trial sites who handle radioactive materials must be educated on the dangers of handling hazardous substances and the proper methods of disposing radioactive or formally radioactive waste, similar to the handling of other medical and bio wastes.

Smaller Reporting Company

We are subject to the reporting requirements of Section 13 of the Exchange Act, and subject to the disclosure requirements of Regulation S-K of the SEC, as a “smaller reporting company.” That designation will relieve us of some of the informational requirements of Regulation S-K.

Sarbanes/Oxley Act

Except for the limitations excluded by the JOBS Act discussed under the preceding heading “Emerging Growth Company,” we are also subject to the Sarbanes-Oxley Act of 2002. The Sarbanes/Oxley Act created a strong and independent accounting oversight board to oversee the conduct of auditors of public companies and strengthens auditor independence. It also requires steps to enhance the direct responsibility of senior members of management for financial reporting and for the quality of financial disclosures made by public companies; establishes clear statutory rules to limit, and to expose to public view, possible conflicts of interest affecting securities analysts; creates guidelines for audit committee members’ appointment, compensation and oversight of the work of public companies’ auditors; management assessment of our internal controls; prohibits certain insiders from trading during pension fund blackout periods; requires companies and auditors to evaluate internal controls and procedures; and establishes a federal crime of securities fraud, among other provisions. Compliance with the requirements of the Sarbanes/Oxley Act will substantially increase our legal and accounting costs.

| 16 |

Exchange Act Reporting Requirements

Section 14(a) of the Exchange Act requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act, like we are, to comply with the rules and regulations of the SEC regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to shareholders at a special or annual meeting thereof or pursuant to a written consent will require us to provide our shareholders with the information outlined in Schedules 14A (where proxies are solicited) or 14C (where consents in writing to the action have already been received or anticipated to be received) of Regulation 14, as applicable; and preliminary copies of this information must be submitted to the SEC at least 10 days prior to the date that definitive copies of this information are forwarded to our shareholders.

We are also required to file annual reports on Form 10-K and quarterly reports on Form 10-Q with the SEC on a regular basis, and will be required to timely disclose certain material events (e.g., changes in corporate control; acquisitions or dispositions of a significant amount of assets other than in the ordinary course of business; and bankruptcy) in a Current Report on Form 8-K.

Number of Total Employees and Number of Full Time Employees

As of the date of this Annual Report, we have four full-time employees. Our CFO is currently part-time.

In 2024, and subject to adequate funding and assuming the Merger is not consummated, we seek to provide our employees with health care coverage and other benefits to help attract and maintain our workforce. We are not currently obligated to provide health insurance, however, we believe this is an important addition to our benefits package. All employees receive at least three weeks of paid time off per year. We have historically provided incentive stock options and other equity incentives to officers, directors and key employees to provide ownership and alignment of interests with our shareholders. We also use in certain instances performance-based vesting for stock options and restricted stock, whereby we set milestones to reflect important value creating initiatives of the Company. As a company, we seek diversity and inclusion in our workplace.

Available Information

We maintain an internet website at www.qsambio.com. We make available on or through our website, free of charge, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practical after we electronically file such material with, or furnish it to, the Securities and Exchange Commission. We do not intend the address of our website to be an active link or to otherwise incorporate the contents of our website into this Annual Report. You may also find all of the reports that we have filed electronically with the SEC at their Internet site www.sec.gov.

Item 1a. Risk Factors

General Risks Related to our Business and Technology

A pandemic, epidemic or outbreak of an infectious disease, such as COVID-19, or coronavirus, may materially and adversely affect our business and our financial results.

In the recent past, the COVID-19 pandemic and efforts to control its spread have significantly impacted the movement of people, goods and services worldwide, including the conduct of our business operations. The COVID-19 pandemic has materially affected segments of the global economy and, if it were to reoccur, may affect our operations by causing a period of business disruption, supply chain issues, including the potential interruption of our clinical trial activities and delays or disruptions in the supply of our products and product candidates. In addition, there could be a potential effect of COVID-19 or any future pandemic, epidemic or outbreak of an infectious disease to the business at FDA or other health authorities, which could result in delays of reviews and approvals, including with respect to our product candidates.

| 17 |

The recurrence of the COVID-19 pandemic, or the spread of any other such disease, globally could also adversely impact our clinical trial operations, including our ability to recruit and retain patients and principal investigators and site staff who, as healthcare providers, may have heightened exposure to disease if an outbreak occurs in their geography. COVID-19, or another infectious disease, could also negatively affect our manufacturing operations, which could result in delays or disruptions in the supply of our product candidates.

Although the immediate impacts of the COVID-19 pandemic have been assessed and mitigated, the ultimate extent of the impact of this or any future pandemic, including as a result of possible subsequent outbreaks of Coronavirus or of new variants thereof and measures taken in response thereto, will depend on future developments, which remain uncertain and cannot currently be predicted. While health and safety restrictions have been lifted and vaccines are available, certain adverse consequences of the pandemic continue to impact the macroeconomic environment and may persist for some time. Any negative impact on our business, financial condition, results of operations and cash flows cannot be reasonably estimated at this time, but the outbreak of any future pandemic could lead to extended disruption of economic activity and the impact on our business, financial condition, results of operations and cash flows could be material.

Given the dynamic nature of variants of COVID-19 and the unpredictability of future pandemics, epidemics or the outbreak of infectious disease, it is difficult to predict its full impact on our business, but if we or any of the third parties with whom we engage were to experience shutdowns or other business disruptions, our ability to conduct our business in the manner and on the timelines presently planned could be materially and negatively impacted, which could have a material adverse effect on our business and our results of operation and financial condition.

Unfavorable global economic, geopolitical conflicts and other political conditions could adversely affect our business, financial condition or results of operations.