UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

| ☒ | Preliminary Information Statement |

| ☐ | Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2)) |

| ☐ | Definitive Information Statement |

QSAM BIOSCIENCES, INC.

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☐ | No fee required. |

| ☒ | Filing Fee computed on table in exhibit per Exchange Act Rules 14c-5(g) and 0-11. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No: | |

| 3) | Filing Party: | |

| 4) | Date Filed: |

PRELIMINARY COPY - SUBJECT TO COMPLETION

QSAM BIOSCIENCES, INC.

9442 Capital of Texas Hwy N, Plaza 1, Suite 500

Austin, TX 78759

NOTICE OF ACTION BY WRITTEN CONSENT AND INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

To the Stockholders of QSAM Biosciences, Inc.:

This notice of action by written consent and the accompanying information statement (this “Information Statement”) is being furnished by the Board of Directors (the “Board”) of QSAM Biosciences, Inc., a Delaware corporation (“QSAM,” the “Company,” “we,” “us” or “our”), to the holders of record at the close of business on [●, 2024] (the “Record Date”) of the outstanding shares of our common stock, par value $0.0001 per share (“Common Stock” or “QSAM Common Stock”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The purpose of the accompanying Information Statement is to inform the Company’s stockholders that on February 6, 2024, holders of over 60% of the voting power of capital stock of the Company acted by an irrevocable written consent (the “Written Consent”) in lieu of a special meeting of stockholders to approve: (1) the Agreement and Plan of Merger (the “Merger Agreement”) by and among Telix Pharmaceuticals Limited, a public limited company registered under the laws of the Commonwealth of Australia (“Buyer” or “Telix”), Cyclone Merger Sub I, Inc., a Delaware corporation and direct wholly-owned subsidiary of Telix (“Merger Sub I”), Cyclone Merger Sub II, Inc., a Delaware corporation and direct wholly-owned subsidiary of Telix (“Merger Sub II”, and collectively with Merger Sub I, the “Merger Subs”) and David H. Clarke, as stockholder representative to the QSAM stockholders (the “QSAM Stockholder Representative”); and (2) a reverse stock split of outstanding shares of our Common Stock in a range between 1:1000 and 1:2000 (the “Reverse Split”), and to authorize the Board to determine the exact ratio at its discretion and to effectuate and file an amendment to the certificate of incorporation of the Company (the “Certificate of Amendment”) immediately prior to the consummation of the Merger.

Pursuant to the terms of the Merger Agreement and the Reverse Split, the aggregate consideration that QSAM stockholders will be entitled to receive pursuant to the Merger and the Reverse Split will be equal to:

(i) USD $33.1 million, reduced by (a) the amount of certain of QSAM’s unpaid expenses, indebtedness, change-of-control bonuses, and other payables as of the closing of the Merger, (b) a fee equal to 218,496 ordinary shares of Telix (“Telix Ordinary Shares”) payable to QSAM’s licensor, IGL Pharma, Inc. (“IGL”), upon the closing of the Merger, representing $1,655,000 (or 5% of the aggregate closing consideration) divided by the Buyer Stock Price (defined below), and (c) 66,011 ordinary shares of Telix (“Telix Ordinary Shares”), representing $500,000 divided by the Buyer Stock Price (defined below), as a source of recovery for post-closing purchase price adjustments (collectively, the “Closing Consideration”); and

(ii) contingent value rights (“CVRs”) which will represent the right to receive contingent payments of up to USD $90 million in the aggregate, in cash and/or Telix Ordinary Shares, without interest, upon the achievement of certain milestones, at the times and subject to the terms and conditions of the CVR Agreement (as defined below) (such contingent payments, the “Milestone Payments”).

The Closing Consideration will be paid to holders of whole numbers of shares of QSAM Common Stock in the Merger in the form of Telix Ordinary Shares, except in certain specified circumstances, while payments in connection with the Reverse Split will be paid in cash. The number of shares issuable to QSAM stockholders in the Merger shall be determined by reference to a deemed value of Telix Ordinary Shares equal to USD $7.5745 per share (the “Buyer Stock Price”), representing the volume weighted average price at which Telix Ordinary Shares traded on the Australian Securities Exchange over the ten (10) trading-day period ending on February 6, 2024, the business day prior to the date of the Merger Agreement, as converted from Australian dollars to United States dollars at the exchange rate published in the Wall Street Journal as of February 6, 2024, the business day prior to the date of the Merger Agreement.

In connection with and as a condition to the Merger, QSAM will effect the Reverse Split, in which any outstanding fractional shares of QSAM Common Stock (determined after determining the whole number of shares of QSAM Common Stock held by such holder, if any) after giving effect to the Reverse Split will be automatically exchanged for (i) the right to receive an amount of cash equal to such fractional share’s pro rata share of the Closing Consideration and (ii) one (1) CVR for each share of QSAM Common Stock that was converted into a fractional share (and not aggregated into a whole number of shares) pursuant to the Reverse Split. For additional details, see “The Merger Agreement – Merger Consideration” on page 44 of the accompanying Information Statement.

The Company’s Board carefully reviewed and considered the terms and conditions of the Merger Agreement and the transactions contemplated thereby, including the Merger and the Reverse Split (the “Transactions”). The Board (i)(A) determined that the Merger Agreement and the Transactions are fair and in the best interests of the Company and its stockholders, (B) approved and declared advisable the Transactions, on the terms and subject to the conditions set forth in the Merger Agreement, and (C) recommended that the stockholders of the Company approve the Transactions, and (ii) directed that the Transactions be submitted to the holders of the Common Stock for their approval.

The approval of the Transactions by the Company’s stockholders via Written Consent was effected in accordance with the Company’s Certificate of Incorporation, as amended (the “Company Charter”), the Amended and Restated Bylaws of the Company (the “Amended and Restated Bylaws”) and the General Corporation Law of the State of Delaware (the “DGCL”). No further approval of the stockholders under the DGCL is required to complete the Transactions. As a result, the Company has not solicited and will not be soliciting your vote for the Transactions and does not intend to call a meeting of stockholders for purposes of voting on the adoption thereof.

Pursuant to Rule 14c-2 of the Exchange Act, the actions contemplated by the Written Consent may not be taken until [●], 2024, which is 20 calendar days following the date we first mail the accompanying Information Statement to our stockholders.

This notice of action by written consent and the accompanying Information Statement shall constitute notice to you from the Company that the Transactions have been approved by the holders of a majority of the voting power of the Common Stock by written consent in lieu of a special meeting in accordance with Section 228(e) of the DGCL.

QSAM IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND QSAM A PROXY.

The Information Statement accompanying this letter provides you with more specific information concerning the Transactions. We encourage you to carefully read the accompanying Information Statement, copies of the Merger Agreement including the annexes and the schedules attached thereto, the Certificate of Amendment, and the other appendices attached to the accompanying Information Statement.

THE INFORMATION STATEMENT IS FOR YOUR INFORMATION ONLY. YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO THE INFORMATION STATEMENT. THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED IN THE INFORMATION STATEMENT.

By Order of the Board of Directors, [●], 2024 | |

| /s/ C. Richard Piazza | |

| C. Richard Piazza, Executive Chairman |

QSAM BIOSCIENCES, INC.

9442 Capital of Texas Hwy N, Plaza 1, Suite 500

Austin, TX 78759

INFORMATION STATEMENT

ABOUT THIS INFORMATION STATEMENT

General

This Information Statement is being furnished by QSAM Biosciences, Inc., a Delaware corporation (“we,” “us”, “our”, “QSAM”, or the “Company”), in connection with action taken by an irrevocable written consent (the “Written Consent”) on February 6, 2024, by the holders of a majority of the voting power of the Company’s issued and outstanding capital stock entitled to vote thereon (the “Majority Stockholders”), approving: (1) the Agreement and Plan of Merger (the “Merger Agreement”) by and among Telix Pharmaceuticals Limited, a public limited company registered under the laws of the Commonwealth of Australia (“Buyer” or “Telix”), Cyclone Merger Sub I, Inc., a Delaware corporation and direct wholly-owned subsidiary of Telix (“Merger Sub I”), Cyclone Merger Sub II, Inc., a Delaware corporation and direct wholly-owned subsidiary of Telix (“Merger Sub II”, and collectively with Merger Sub I, the “Merger Subs”) and David H. Clarke, as stockholder representative to the QSAM stockholders (the “QSAM Stockholder Representative”); and (2) a reverse stock split of outstanding shares of our Common Stock in a range between 1:1000 and 1:2000 (the “Reverse Split”), and to authorize the Board to determine the exact ratio at its discretion and to effectuate and file an amendment to the certificate of incorporation of the Company (the “Certificate of Amendment”) immediately prior to the consummation of the Merger.

Pursuant to the Merger Agreement, the Buyer, the Merger Subs and the Company intend to effect a reorganization in which, as steps in a single, integrated transaction, (a) Merger Sub I will merge with and into the Company, Merger Sub I will cease to exist, and the Company will survive as a direct, wholly owned subsidiary of Buyer (the “First Merger”), and (b) as part of the same overall transaction, the Company will merge with and into Merger Sub II, the Company will cease to exist, and Merger Sub II will survive as a direct, wholly owned subsidiary of Buyer (the “Second Merger” and, collectively with the First Merger, as appropriate, the “Merger”). The closing of the First Merger is referred to herein as the “Closing”, the filing of the certificate of merger in connection with the First Merger, the “First Effective Time”, and the filing of certificate of merger in connection with the Second Merger, the “Second Effective Time.”

Vote Required

As the matters set forth in this Information Statement have been duly authorized and approved by the written consent of the holders of at least a majority of the voting power of the Company’s issued and outstanding capital stock entitled to vote thereon, we are not seeking any consent, vote or authorization. Section 228 of the DGCL provides that any action required or permitted to be taken by the stockholders of the Company may be effected by the consent in writing of the holders of outstanding capital stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

Holders of the Company’s Common Stock are entitled to one vote per share.

As of the close of business on the date of Written Consent, 4,387,282 shares of Common Stock were issued and outstanding. The Majority Stockholders together represented an aggregate of 2,694,512 shares of Common Stock, constituting over 60% of the voting power of the Company’s issued and outstanding capital stock. Accordingly, the Written Consent has been executed and delivered to the Company by the Majority Stockholders pursuant to Section 228 of the DGCL.

Notice Requirement

The purpose of this notice and the accompanying Information Statement is to (1) inform the Company’s stockholders of the action described above before it takes effect, in accordance with Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and (2) provide the notice required under Section 228(e) of the Delaware General Corporation Law (the “DGCL”) of the taking of a corporate action by written consent to stockholders of the Company as of the Record Date who have not consented in writing to such action and who would have been entitled to notice of the meeting if the action had been taken at a meeting. This Information Statement serves as the notice required by Section 228(e) of the DGCL. In accordance with Rule 14c-2 under the Exchange Act, the actions described herein will become effective no earlier than the 20th calendar day after the date on which this definitive Information Statement has been provided to the Company’s stockholders. The Information Statement is being mailed on or about [●], 2024, to the Company’s stockholders of record as of the close of business on the Record Date.

Dissenter’s Rights of Appraisal

Stockholders of the Company’s Common Stock are entitled to exercise dissenter rights with respect to the Merger. These rights can be referenced on page 39 of this Information Statement.

Expenses

We will bear all expenses in connection with the distribution of this Information Statement.

Currency

Unless otherwise specified in this Information Statement, all monetary amounts are in U.S. dollars, all references to “$,” “US$,” “USD” and “dollars” mean U.S. dollars, and all references to “A$” and “AUD” mean Australian dollars.

Table of Contents

| -i- |

This summary highlights selected information appearing elsewhere in this Information Statement and is, therefore, qualified in its entirety by the more detailed information appearing elsewhere in this Information Statement. It may not contain all the information that is important to you. The Company urges you to read carefully this entire Information Statement and the other documents to which it refers to understand fully the terms of the Merger. You should pay special attention to “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements.”

The Parties

Telix Pharmaceuticals Limited

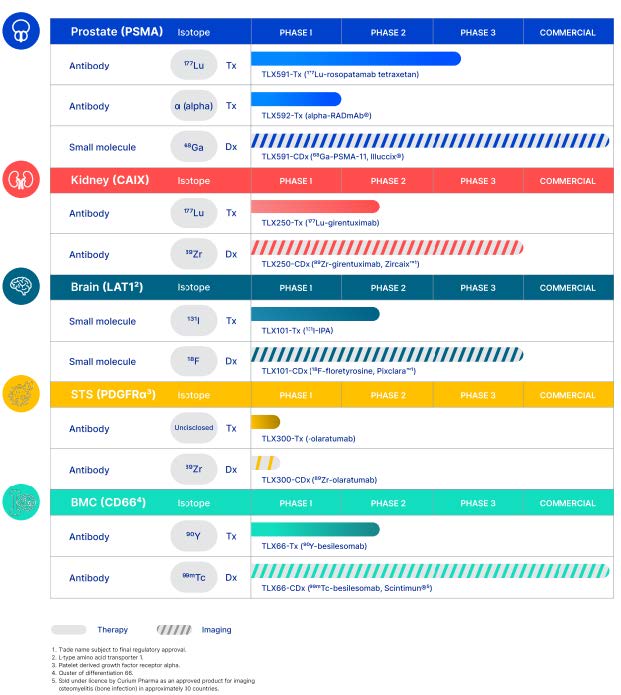

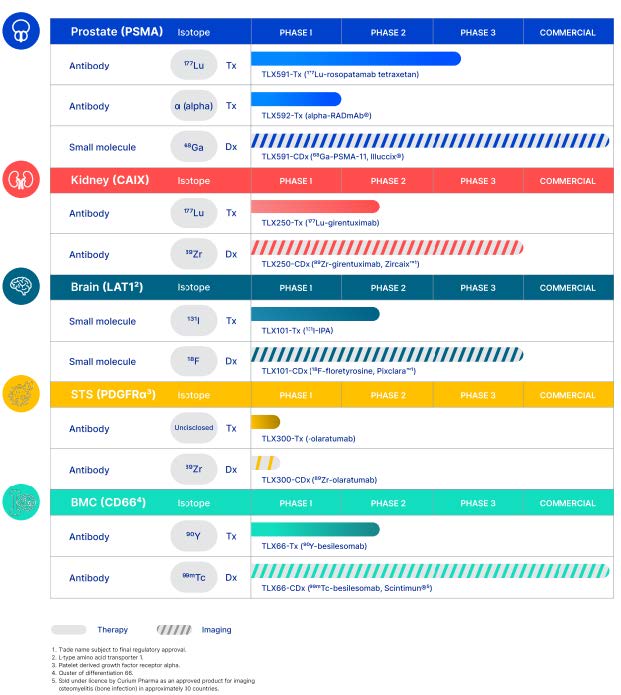

Telix Pharmaceuticals Limited (“Telix” or “Buyer”), is a public limited company registered under the laws of the Commonwealth of Australia. Telix is a biopharmaceutical company focused on the development and commercialization of diagnostic and therapeutic radiopharmaceuticals and associated medical devices. Telix is headquartered in Melbourne, Australia with international operations in the United States, Europe (Belgium and Switzerland), and Japan. Telix is developing a portfolio of clinical-stage products that aims to address significant unmet medical needs in oncology and rare diseases. Telix’s ordinary shares are listed on the Australian Securities Exchange (ASX: TLX).

Telix’s principal executive offices are located at 55 Flemington Road, North Melbourne, Victoria, 3051, Australia, and its reception telephone number is +61 3-9093-3855. The corporate website address is www.telixpharma.com. Telix’s website and the information contained on, or that can be accessed through the website, is not deemed to be incorporated by reference in, and is not considered part of, this Information Statement.

Merger Sub I

Cyclone Merger Sub I, Inc., a Delaware corporation (referred to as “Merger Sub I”), is a wholly owned subsidiary of the Buyer. Merger Sub I was formed by the Buyer solely in contemplation of the Merger, has not conducted any business and has no assets, liabilities or obligations of any nature other than as set forth in the Merger Agreement.

Merger Sub II

Cyclone Merger Sub II, Inc., a Delaware corporation (referred to as “Merger Sub II”), is a wholly owned subsidiary of the Buyer. Merger Sub II was formed by the Buyer solely in contemplation of the transactions, has not conducted any business and has no assets, liabilities or obligations of any nature other than as set forth in the Merger Agreement.

QSAM

QSAM develops next-generation nuclear medicines for the treatment of cancer. QSAM’s technology is Samarium-153 DOTMP, a/k/a CycloSam® (“CycloSam®” or the “Technology”), a clinical-stage bone targeting radiopharmaceutical. CycloSam® features a patented, low specific activity form of Samarium-153, a beta-emitting radioisotope with a short 46-hour half-life, and the chelating agent DOTMP, which selectively targets sites of high bone mineral turnover and reduces off-site migration of the tumor-killing radiation. Improvements in formulation and manufacturing from a prior FDA-approved drug utilizing the same radioisotope (Quadramet®) has resulted in our drug candidate demonstrating significantly less impurities, lower costs and more frequent availability.

In August 2021, the Food & Drug Administration (FDA) cleared QSAM’s Investigational New Drug (IND) application to commence Phase 1 clinical trials for CycloSam® as a treatment for cancer that has metastasized to the bone from the lung, breast, prostate and other areas. QSAM initiated this trial in November 2021 and to date has dosed five patients. Also in August 2021, the FDA granted Orphan Drug Designation for the use of CycloSam® to treat a primary bone cancer called osteosarcoma, a devastating disease that mostly affects children and young adults; and in February 2022, the FDA granted Rare Pediatric Disease Designation for the same indication.

| 1 |

What is CycloSam®. CycloSam® is a targeted, bone seeking radiopharmaceutical that combines the beta-emitting radioisotope Samarium-153 (153Sm) with a chelating agent, DOTMP (1, 4, 7, 10-tetraazacyclododecane-1, 4, 7, 10-tetramethylenephosphonic acid). Samarium-153 is acquired from a third-party nuclear reactor and the chelating agent is supplied in the form of kits. Chelating agents are organic compounds capable of linking together metal ions to form complex ring-like structures. This combination forms a stable complex which delivers a radioactive dose to sites of rapid bone mineral turnover such as bone cancers and tumors. CycloSam® has a physical half-life of 46 hours (radiation decreases by half in 46 hours) and emits both medium-energy beta particles that produce the therapeutic effect, and gamma photons that make it possible to take images of the skeleton and locate and characterize the size and nature of tumors. The use of radioisotopes to both diagnose and treat disease is called “theranostics” and is a rapidly growing area of medical discovery.

QSAM’s principal executive offices are located at 9442 Capital of Texas Hwy N, Plaza 1, Suite 500, Austin, Texas 78759, and the telephone number is 512-343-4558. The corporate website address is www.qsambio.com. QSAM’s website and the information contained on, or that can be accessed through the website, is not deemed to be incorporated by reference in, and is not considered part of, this Information Statement.

The Merger

QSAM Board Recommendation and its Reasons for the Merger

The QSAM Board unanimously approved the Merger, adoption of the Merger Agreement, and the transactions and agreements arising out of the Merger.

In the course of reaching its decision to approve the Merger Agreement and the transactions contemplated thereby, the QSAM Board considered a number of factors. For a more complete discussion of these factors, see “The Merger—Rationale for the Merger” beginning on page 29.

Opinion of QSAM’s Financial Advisor

QSAM retained Newbridge Securities Corporation (“Newbridge”) to act as its financial advisor in connection with entering into a Merger Agreement with Telix. Pursuant to its engagement, QSAM’s Board requested that Newbridge render an opinion to the Board as to the fairness, from a financial point of view, to the holders of the outstanding shares of QSAM Common Stock (other than such holders who properly exercise appraisal rights with respect to their common stock), of the Closing Consideration to be paid to the QSAM stockholders pursuant to the terms and subject to the conditions set forth in the Merger Agreement. On February 2, 2024, Newbridge delivered its oral opinion to the Board (subsequently confirmed in its written opinion dated February 7, 2024) to the effect that, based upon and subject to the assumptions, qualifications and limitations stated in its written opinion, as of November 14, 2023 (the date on which QSAM and Telix first announced the signing of the term sheet contemplating the Merger), the Closing Consideration was fair, from a financial point of view, to the QSAM stockholders. The full text of Newbridge’s written opinion to QSAM’s Board, which describes, among other things, the assumptions made, procedures followed, factors considered and limitations on the review undertaken, is attached as Appendix C hereto and is incorporated by reference herein in its entirety. Newbridge provided its opinion, which was addressed to QSAM’s Board, for the information, assistance and use of the Board in connection with its consideration of the Merger Agreement.

For a further discussion of Newbridge’s opinion, see “The Merger—Opinion of QSAM’s Financial Advisor” beginning on page 31, which provides a summary of Newbridge’s opinion and the methodology that Newbridge used to render its opinion that is qualified in its entirety by reference to the full text of the opinion attached hereto as Appendix C.

| 2 |

Interests of QSAM Non-Employee Directors, Key Employees and Key Consultant in the Merger

In considering the recommendation of the QSAM Board with respect to the Merger, QSAM stockholders should be aware that QSAM’s executive officers, C. Richard Piazza, Douglas Baum and Christopher Nelson, and one key employee, Namrata Chand (collectively, the “Key Employees”), as well as two non-employee director members of QSAM’s Board, Charles J. Link and Adriann Sax (collectively, the “Directors”), and QSAM’s CFO, Adam King (the “Key Consultant”), have various interests in the Merger that may be in addition to, or different from, the interests of QSAM stockholders generally. The members of the QSAM Board were aware of these interests and considered them at the time they approved the Merger Agreement and in making their recommendation that QSAM stockholders adopt the Merger Agreement. The Majority Stockholders were also made aware by the Board of these interests and found them to be fair, just, and reasonable and in the best interest of the Company and its stockholders as indicated in the Written Consent. These interests include, but are not limited to:

● The Key Employees may be entitled to receive severance payments and benefits, as provided in their respective employment agreements, as amended, if their employment with the Company terminates without cause or following a material change, as such terms are defined in the applicable employment agreements. Such severance payments and benefits are not payable if the Key Employee is not subject to a termination of employment, such as would be the case if a Key Employee continues employment following the closing of the Merger. In addition, certain Key Employees may agree to forego the severance payments and benefits in part or in their entirety due to lack of financial resources at QSAM and the adverse impact it may have on the Closing Consideration; and

● The Key Employees and one Director, Charles J. Link, may receive transaction bonuses in the aggregate amount of 6.25% of the Closing Consideration (calculated after deduction of the IGL License Fee in the amount of $1,655,000 payable at the closing of the Merger and less any unpaid QSAM expenses that are not being assumed by Telix) in connection with the Merger, pursuant to, with respect to the Key Employees, the terms of their respective employment agreements, as amended, and, with respect to the Director, as provided in an agreement between the Director and the Company. These individuals may also be entitled to receive transaction bonuses in the aggregate of 6.25% of any Milestone Payments, after deduction of the amount of the IGL License Fee, that become payable in accordance with the terms of the Merger Agreement.

● The Directors, Key Employees and Key Consultant have been issued restricted shares of common stock (the “Restricted Shares”) that are subject to performance and time-based vesting and that will accelerate and become fully vested upon the closing of the Merger.

For additional information on the interests of the Directors, Key Employees and Key Consultant in the Merger, see “The Merger—Interests of QSAM Directors, Key Employees and Key Consultant in the Merger” beginning on page 36.

Regulatory Approvals

Telix and QSAM have each agreed to use their reasonable best efforts to take all actions and to do all things necessary, proper or advisable to consummate and make effective the Merger and the other transactions contemplated by the Merger Agreement.

Neither Telix nor QSAM is aware of any material regulatory approvals or actions that are required for completion of the Merger. It is presently contemplated that if any such additional regulatory approvals or actions are required, those approvals or actions will be sought. There can be no assurance, however, that any additional approvals or actions will be obtained.

De-Listing and Deregistration of QSAM Common Stock After the Merger

Following the Merger, QSAM Common Stock currently trading on the OTCQB tier of the OTCMKTS will cease trading and will be deregistered under the Exchange Act as promptly as practicable after the Closing.

Appraisal Rights

QSAM Stockholders and beneficial owners will have the right to demand appraisal of their shares of QSAM Common Stock and obtain payment in cash for the fair value of their shares, only if they perfect their appraisal rights and comply with the applicable provisions of Delaware law. A copy of Section 262 (“Section 262”) of the General Corporation Law of the State of Delaware (the “DGCL”) related to appraisal rights is attached as Appendix D to this Information Statement, and a summary of these provisions can be found under “The Merger—Appraisal and Dissenters Rights” beginning on page 39. It is a condition precedent to the completion of the Merger that the aggregate number of dissenting shares shall not exceed two percent (2%) of the number of outstanding shares of Company capital stock, on a fully-diluted basis, as of the First Effective Time. Due to the complexity of the procedures for exercising the right to seek appraisal, QSAM stockholders and beneficial owners who are considering exercising such rights are encouraged to seek the advice of legal counsel. Failure to strictly comply with Section 262 may result in the loss of the right of appraisal.

| 3 |

Anticipated Accounting Treatment of the Merger

The Merger is expected to be accounted for as an asset acquisition pursuant to IFRS 3–Business Combinations as well as IAS 38-Intangible Assets.

The Merger Agreement

On February 7, 2024, Telix and QSAM entered into the Merger Agreement attached as Appendix A to this Information Statement. QSAM’s Board and the Telix Board of Directors (the “Telix Board”) have both unanimously approved the Merger pursuant to the terms of the Merger Agreement. You are encouraged to read the entire Merger Agreement carefully because it is the principal legal document governing the Merger.

Structure of the Merger (page 43)

Buyer, the Merger Subs and the Company intend to effect a reorganization in which, as steps in a single, integrated transaction, (a) Merger Sub I will merge with and into the Company, Merger Sub I will cease to exist, and the Company will survive as a direct, wholly owned subsidiary of Buyer, and (b) as part of the same overall transaction, the Company will merge with and into Merger Sub II, the Company will cease to exist, and Merger Sub II will survive as a direct, wholly owned subsidiary of Buyer.

The parties intend that the Merger qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and that the Merger be a “plan of reorganization” for purposes of Sections 354 and 361 of the Code and within the meaning of Section 1.368-2(g) of the United States Treasury regulations promulgated under the Code.

Merger Consideration (page 44)

Stock, Cash and CVR Consideration:

Pursuant to the terms of the Merger Agreement and the Reverse Split, the aggregate consideration that QSAM stockholders will be entitled to receive pursuant to the Merger and the Reverse Split will be equal to:

(i) USD $33.1 million, reduced by (a) the amount of certain of QSAM’s unpaid expenses, indebtedness, change-of-control bonuses, and other payables as of the closing of the Merger, (b) a fee equal to 5% of the aggregate closing consideration payable to QSAM’s licensor, IGL Pharma, Inc. (“IGL”), upon the closing of the Merger, and (c) 66,011 ordinary shares of Telix (“Telix Ordinary Shares”), representing $500,000 divided by the Buyer Stock Price (defined below), as a source of recovery for post-closing purchase price adjustments (collectively, the “Closing Consideration”); and

| 4 |

(ii) contingent value rights (“CVRs”) which will represent the right to receive contingent payments of up to USD $90 million in the aggregate, in cash and/or Telix Ordinary Shares, without interest, upon the achievement of certain milestones, at the times and subject to the terms and conditions of the CVR Agreement (as defined below).

The Closing Consideration will be paid to holders of whole numbers of shares of QSAM Common Stock in the Merger in the form of Telix Ordinary Shares, except in certain specified circumstances, while payments in connection with the Reverse Split will be paid in cash. The number of shares issuable to QSAM stockholders in the Merger shall be determined by reference to a deemed value of Telix Ordinary Shares equal to USD $7.5745 per share (the “Buyer Stock Price”), representing the volume weighted average price at which Telix Ordinary Shares traded on the Australian Securities Exchange over the ten (10) trading-day period ending on February 6, 2024, the business day prior to the date of the Merger Agreement, as converted from Australian dollars to United States dollars at the exchange rate published in the Wall Street Journal as of February 6, 2024, the business day prior to the date of the Merger Agreement. The Buyer Stock Price is a negotiated, agreed, fixed value, and the trading price of Telix’s Ordinary Shares could be, at the time of the Merger, higher or lower than the Buyer Stock Price.

Subject to the foregoing and the other risks and uncertainties set forth below under Forward-Looking Statements, QSAM management currently estimates the value payable at the closing of the Merger and/or in the Reverse Split with respect to each share of QSAM Common Stock that will be outstanding prior to the Reverse Split will be approximately $6.63, which would equate to approximately 0.876 Telix Ordinary Shares for each whole share of QSAM Common Stock (the “Exchange Ratio”) prior to giving effect to the Reverse Split. This estimate is based on QSAM’s estimate of its expenses through the closing of the Merger in excess of certain expenses, in an amount equal to $500,000 in the aggregate, that Telix has agreed to assume, as well as QSAM’s estimate of the total shares of QSAM Common Stock outstanding immediately prior to the Reverse Split and the closing of the Merger.

As described above, the amount of cash and/or shares of Telix Ordinary Shares payable with respect to each outstanding share of QSAM Common Stock is subject to adjustment prior to closing based on, among other things, (i) the amount of QSAM’s indebtedness, unpaid expenses, change-of-control, and similar payments, in each case in connection with the Merger, as well as (ii) the fully diluted number of shares of QSAM common stock issued and outstanding as of the date of closing of the Merger, which could increase if certain stock options are exercised or other reasons. As a result, the actual amount of Closing Consideration could be lower on the date of Closing than was previously estimated as of the date of the Merger Agreement and as of the date of this Information Statement. For illustration purposes only, if indebtedness, expenses or other payables at closing is $500,000 greater than the current estimate of $3.62 million, then the value payable at the closing of the Merger and/or in the Reverse Split with respect to each share of QSAM Common Stock that is outstanding prior to the Reverse Split would be approximately $6.52, which would equate to an Exchange Ratio of 0.861 Telix Ordinary Shares for each whole share of QSAM Common Stock prior to giving effect to the Reverse Split. Similarly, if the outstanding shares of QSAM Common Stock are greater by 100,000 shares at the time of Closing due to exercise of stock options, the value payable at the closing of the Merger and/or in the Reverse Split with respect to each share of QSAM Common Stock that is outstanding prior to the Reverse Split would be approximately $6.49, which would equate to an Exchange Ratio of 0.856 Telix Ordinary Shares for each whole share of QSAM Common Stock prior to giving effect to the Reverse Split. These two examples of possible changes to the Closing Consideration payable to QSAM shareholders are shown in the table below:

| Assumptions | Estimated Value per QSAM Share | Estimated Exchange Ratio | ||||||

| Current estimates of total QSAM shares outstanding and total closing indebtedness | $ | 6.63 | 0.876 | |||||

| Closing indebtedness $500,000 greater than current estimate | $ | 6.52 | 0.861 | |||||

| Total QSAM shares outstanding 100,000 greater than current estimate | $ | 6.49 | 0.856 | |||||

| 5 |

In connection with and as a condition to the Merger, QSAM will effect a reverse stock split of all the issued and outstanding shares of QSAM Common Stock, in a ratio between 1:1000 and 1:2000 (the “Reverse Split”) (as determined by the QSAM Board prior to closing), in which any outstanding fractional shares of QSAM Common Stock (determined after determining the whole number of shares of QSAM Common Stock held by such holder, if any) after giving effect to the Reverse Split will be automatically exchanged for (i) the right to receive an amount of cash equal to such fractional share’s pro rata share of the Closing Consideration and (ii) one (1) CVR for each share of QSAM Common Stock that was converted into a fractional share (and not aggregated into a whole number of shares) pursuant to the Reverse Split.

In connection with the Reverse Split, all per share values and exchange ratios set forth above would be proportionately increased. For instance, in the case of a 1:1000 Reverse Split, where every 1,000 shares will consolidate into one share, the currently estimated value per share of QSAM Common Stock would be $6.63 X 1,000 = $6,630, and the estimated Exchange Ratio would be 0.876 X 1,000 = 876.

All QSAM stockholders will receive one Contingent Value Rights (“CVR”) certificate for every share they held prior to the Reverse Split. The non-transferrable CVRs provide their holder with a right to receive contingent payments from the Buyer upon achievement of certain clinical, regulatory and commercial milestones described below, up to a total aggregate value of $90 million (the “Earnout Consideration”). There is no guarantee that the Buyer will achieve any of the milestones in the timeframe required, and the Earnout Consideration may never be paid. See “The Contingent Value Rights Agreement” beginning on page 56 below.

The Telix Ordinary Shares issued in the Merger or pursuant to the CVR Agreement will not be registered under the Securities Act of 1933, as amended (the “Securities Act”) and will be issued pursuant to an exemption to the registration requirements thereunder. The Telix Ordinary Shares will be subject to escrow and held on the issuer sponsored subregister and subject to a holding lock for any required holding period under Rule 144 of the Securities Act. If Telix determines that a valid exemption to the registration requirements under the Securities Act would not be available with respect to the issuance of any Telix Ordinary Shares, it may, with the approval of the QSAM Stockholder Representative (not to be unreasonably withheld, conditioned or delayed) elect to pay such QSAM stockholders exclusively in cash in lieu of Telix Ordinary Shares.

Treatment of Options (page 36)

Pursuant to Merger Agreement, effective as of the date QSAM files the definitive Information Statement, each then-outstanding and unexercised option to purchase shares of QSAM Common Stock issued pursuant to any stock incentive or equity-related agreement or plan of QSAM (each such option, a “QSAM Option”) will vest in full and become exercisable up to and through the close of regular trading on the seventh business day after the date the definitive Information Statement is filed (such date, the “Last Exercise Date”) in accordance with the terms and conditions of such QSAM Option, and such QSAM Option will terminate for no consideration and be of no further force or effect as of immediately prior to closing if not exercised by the holder on or prior to the close of regular trading on the Last Exercise Date. According to the terms of the grants made by the Company, all QSAM Options were fully vested as of March 31, 2024 and will remain exercisable until the Last Exercise Date.

| 6 |

Conditions to Completion of the Merger (page 51)

The obligations of each of the parties to consummate the Merger are subject to the satisfaction (or waiver by each of Telix and QSAM if permissible under applicable law) prior to the First Effective Time, of certain conditions, including:

| ● | the continued accuracy of the parties’ representations and warranties contained in the Merger Agreement subject to certain specified materiality standards; | |

| ● | compliance with covenants contained in the Merger Agreement in all material respects; | |

| ● | the absence of any law or order of any governmental authority of competent jurisdiction that enjoins, prohibits or makes illegal the consummation of the Merger; | |

| ● | the Reverse Split shall have been effected; | |

| ● | there shall be no more than 27 Company stockholders that are not “accredited investors”; | |

| ● | exercise of dissenters’ rights by no more than two percent (2%) of the Common Stock outstanding on the First Effective Date; | |

| ● | the absence of any material adverse effect with respect to QSAM as further described in “The Merger Agreement—Definition of ‘Material Adverse Effect’” beginning on page 48 and “The Merger Agreement—Conditions to Completion of the Merger” beginning on page 51. |

QSAM cannot be certain when, or if, the conditions to the Merger will be satisfied or waived, or that the Merger will be completed on the terms and conditions as provided in the Merger Agreement or at all.

Termination of the Merger Agreement (page 53)

The Merger Agreement may be terminated at any time prior to the First Effective Time under the following circumstances:

| ● | by mutual written consent of the Buyer and QSAM; | |

| ● | by either the Buyer or QSAM if the Merger has not been consummated on or before August 7, 2024, (subject to extension as set forth in the Merger Agreement); | |

| ● | by either the Buyer or QSAM if the consummation of any of the transactions contemplated hereby is permanently enjoined, prohibited or otherwise restrained by the terms of a final, non-appealable order or judgment of a court of competent jurisdiction; | |

| ● | by QSAM if either the Buyer and/or Merger Sub breaches or otherwise fails to perform any of their respective representations or covenants that would cause the failure of any of the related closing conditions to be satisfied; and | |

| ● | by the Buyer if QSAM breaches or otherwise violates any of its representations or covenants that would cause the failure of any of the related closing conditions to be satisfied. |

Fees and Expenses (page 55)

Generally, all fees and expenses incurred in connection with the Merger Agreement, the CVR Agreement and the transactions contemplated by the Merger Agreement will be paid by the party incurring such expenses, whether or not the Merger is consummated. See “The Merger Agreement—Fees and Expenses” beginning on page 55. Additionally, Telix has agreed to pay or assume specified items of indebtedness and transaction expenses of the Company in an amount not to exceed $500,000.

| 7 |

The Contingent Value Rights Agreement

At or prior to the First Effective Time, Telix and QSAM will enter into a CVR Agreement, substantially in the form attached as an exhibit to the Merger Agreement, with a rights agent designated by Telix (the “Rights Agent”) governing the terms of the CVRs that the holders of QSAM Common Stock as of the effective time of the Reverse Split and the Merger will be entitled to receive in connection with the Reverse Split and the Merger, respectively (the “CVR Agreement”). The right to the contingent consideration as evidenced by the CVR Agreement is a contractual right only and will not be transferable, except in the limited circumstances specified in the CVR Agreement.

Pursuant to the CVR Agreement, each CVR will entitle the holder thereof to receive such CVR’s ratable allocation (based on the total number of CVRs outstanding) of the Earnout Consideration from Telix upon the achievement of certain milestones (the “Milestones”), if achieved, by the date that is the ten-year anniversary of the closing of the Merger (“Milestone Period”). The Milestone Payments, if any become payable, will be made in Telix Ordinary Shares and/or cash, upon the terms and subject to the conditions set forth in the CVR Agreement. Telix has agreed to use commercially reasonable efforts, on terms specified in the CVR Agreement, to, among other things, develop an acquired product in the United States, France, Germany, Italy, Spain, Japan, United Kingdom, Australia, Canada, Brazil or China (each a “Major Market Country”) and to commercialize at least one acquired product in the Major Market Countries after receipt of the applicable regulatory approval. For more details, see “The Contingent Voting Rights Agreement” on page 56.

| Milestone | Milestone Payment | |

| Successful Completion of a Pivotal Clinical Trial with respect to any acquired product | USD $10 million | |

| First Commercial Sale in a Major Market Country for any Indication | USD $20 million | |

| First Commercial Sale in a Major Market Country for the second Indication | USD $10 million | |

| Cumulative worldwide Net Sales for any and all acquired products of USD $500 million | USD $50 million |

The amount of each Milestone Payment is subject to reduction in the event any amount is set-off pursuant to Telix’s indemnification rights under the Merger Agreement, including the amount of any additional fees owed pursuant to the IGL License Fee and any transaction bonuses to officers, directors or employees of QSAM payable in connection with any such milestone payment, or in the event the QSAM Stockholder Representative is entitled to reimbursement from or indemnification by the QSAM stockholders pursuant to the Merger Agreement.

If and when a Milestone Payment becomes due pursuant to the terms of the CVR Agreement, Telix will pay the Rights Agent the aggregate amount of such Milestone Payment, who will then distribute the Milestone Payment among the holders of CVRs.

Reverse Stock Split (page 60)

On February 6, 2024, the Board approved and recommended that its stockholders approve, and on February 6, 2024, the Majority Stockholders took action by written consent to approve an amendment to the Certificate of Incorporation, as amended (the “Company Charter”) to effect a reverse stock split of outstanding shares of the Company’s Common Stock at a ratio in the range of 1:1000 and 1:2000, such ratio to be determined by the Board at a later date at its sole discretion, but prior to the Closing, if at all, and only in connection with the Merger. The Board may choose not to undertake the Reverse Split at all if it finds it to be unnecessary to complete the Merger.

| 8 |

QSAM stockholders will receive Telix Ordinary Shares in the Merger. The Telix Ordinary Shares will be issued pursuant to an exemption from registration of shares under Section 4(a)(2) or Regulation D of the Securities Act to “accredited investors” as that term is defined thereunder. Regulation D provides that there be no more than 35 non-accredited investors in an offering utilizing the safe harbor exemption in connection with a private placement. Accordingly, the Merger Agreement contemplates that there be no more than 27 non-accredited investors at the time of Closing, who may receive Telix Ordinary Shares. However, the Buyer may, with the approval of the QSAM Stockholder Representative, elect to pay a non-accredited investor in lieu of Telix Ordinary Shares, cash in an amount equal to the shareholder’s pro rata share of the Closing Consideration. The Reverse Split will be conducted in order to assure that the issuance of Telix Ordinary Shares complies with these U.S. securities regulations.

Pursuant to the Reverse Split, any outstanding fractional shares of QSAM Common Stock (determined after determining the whole number of shares of QSAM Common Stock held by such holder, if any) after giving effect to the Reverse Split will be automatically exchanged for (i) the right to receive an amount of cash equal to such fractional share’s pro rata share of the Closing Consideration and (ii) one (1) CVR for each share of QSAM Common Stock that was converted into a fractional share (and not aggregated into a whole number of shares) pursuant to the Reverse Split.

Our Board authorized, and the Majority Stockholders have approved the Reverse Split, which may be effected only in connection with the Merger immediately preceding the First Effective Date.

Risk Factors (page 12)

You should consider all the information contained in or incorporated by reference into this Information Statement. In particular, you should consider the factors described under “Risk Factors” beginning on page 12. Some of the risks related to QSAM, Telix and the Merger are summarized below:

| ● | Substantial doubt exists as to QSAM’s ability to continue as a going concern if the Merger does not occur. Unless the Merger occurs or QSAM is able to raise additional capital during the second quarter of 2024 to continue to finance QSAM’s operations, QSAM’s long-term business plan may not be accomplished, and QSAM may be forced to cease, restructure, reduce, or delay operations. QSAM’s efforts to raise additional funds could be affected by negative conditions in the capital markets, which in recent months have been especially challenging, and there are numerous companies in the pharmaceutical and biotech sectors seeking additional capital from many of the same sources, which may also limit the amount of capital, if any, available to QSAM. | |

| ● | The number of Telix Ordinary Shares that QSAM stockholders will receive as stock consideration is based on a fixed aggregate purchase price and fixed Buyer Stock Price, and will not be adjusted in the event of any change in the price of either Telix Ordinary Shares or QSAM Common Stock. Because the market price of Telix Ordinary Shares will fluctuate, QSAM stockholders cannot be certain of the value of the stock consideration that they will receive at the time of or following Closing. | |

| ● | QSAM stockholders will have a substantially smaller ownership and voting interest in Telix upon completion of the Merger, compared to their ownership and voting interest in QSAM prior to the Merger. | |

| ● | Your Telix Ordinary Shares will be “restricted securities” and will not be available for sale for at least a period of one year under Rule 144 of the U.S. Securities Act unless Telix chooses to become a reporting company under U.S. securities law, in which case, your Telix Ordinary Shares will not be available for sale for at least a period of six (6) months from closing of the Merger, provided that Telix has been a reporting company for at least 90 days prior to the date of sale. | |

| ● | The market price of Telix Ordinary Shares may decline as a result of or following the completion of the Merger. | |

| ● | QSAM stockholders may not receive any payments under the CVRs, and even if they do receive payments the timing and the exact amount of such payments (in the instance, for example, of an off-set from an indemnity claim) is uncertain, which makes it difficult to value the CVR. |

| 9 |

COMPARATIVE PER SHARE MARKET PRICE AND DIVIDEND INFORMATION

Market Prices

Telix Ordinary Shares are listed on the Australian Stock Exchange (ASX) under the symbol “TLX.” QSAM Common Stock is traded on the OTCQB under the symbol “QSAM.” The following table sets forth the Buyer Stock Price, i.e. the price utilized to determine the number of Telix Ordinary Shares issuable to QSAM stockholders, as of February 6, 2024 (one day prior to the date of execution of the Merger Agreement) and the closing price of QSAM Common Stock on the same date, and the closing price per share of Telix Ordinary Shares and QSAM Common Stock on [●], 2024, the most recent practicable trading day prior to the date of this Information Statement for which this information was available. Any over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions. The table also shows the implied value of the stock consideration for each share of QSAM Common Stock as of the same dates. This implied value was calculated by multiplying the closing price of a Telix Ordinary Share on the relevant date by the estimated Exchange Ratio. All values in the following section are in United States dollars; the conversion price from Australian dollars to United States dollars is at the exchange rate published in the Wall Street Journal as of the relevant date.

Telix Ordinary Shares (ASX) | QSAM Common Stock (OTCQB) | Implied Per Share Value of | ||||||||||

| February 6, 2024 | $ | 7.57 | $ | 5.10 | $ | 6.63 | ||||||

| [●], 2024 | $ | [● | ] | $ | [● | ] | $ | [● | ] | |||

The market prices of Telix Ordinary Shares and QSAM Common Stock have fluctuated since the date of execution of the Merger Agreement and will continue to fluctuate from the date of this Information Statement to the date the Merger is completed. No assurance can be given concerning the market prices of Telix Ordinary Shares and shares of QSAM Common Stock before completion of the Merger or shares of Telix Ordinary Shares after completion of the Merger. Except as mentioned elsewhere in this Information Statement, the Closing Consideration will not be adjusted prior to Closing due to fluctuations in the market prices of QSAM Common Stock or Telix Ordinary Shares. As such, fluctuations in the market price of Telix Ordinary Shares between the date of execution of the Merger Agreement and Closing may change the implied total stock consideration and the per share value of the stock consideration at Closing. For example, prior to the Closing Date, every USD $1.00 increase or decrease in the value of Telix Ordinary Share relative to the Buyer Stock Price will result in an adjustment of USD $0.876 in the implied per share value of the stock consideration presented in the table above based on the currently estimated Exchange Ratio, which as discussed above, may change prior to the closing of the Merger. After the Closing, QSAM stockholders are cautioned that the market value of the Telix Ordinary Shares may vary significantly from its market value as of the date of execution of the Merger Agreement and the date of this Information Statement. Additionally, since fractional shares of QSAM Common Stock resulting from the Reverse Split will be exchanged for cash equal to such fractional share’s pro rata share of the Closing Consideration, and such value is not affected by fluctuations in the stock price of Telix Ordinary Shares, it is possible that the cash received for fractional shares may be higher or lower than the value of the stock consideration received by QSAM stockholders. See “Risk Factors—Risks Related to the Merger” beginning on page 12.

Following the Merger, there will be no further market for shares of QSAM Common Stock and QSAM anticipates that its stock will be delisted from OTCMKTS and deregistered under the Exchange Act. As a result, following the Merger and such deregistration, QSAM would no longer file periodic reports with the SEC.

Dividends

QSAM has never declared or paid any cash dividends on shares of QSAM Common Stock. Under the terms of the Merger Agreement, during the period before completion of the Merger, QSAM is not permitted to declare, set aside, make or pay any dividend or other distribution, other than dividends or distributions by wholly-owned subsidiaries of QSAM to QSAM or another wholly-owned subsidiary of QSAM.

After completion of the Merger, any former QSAM stockholder who holds shares of Telix Ordinary Shares into which shares of QSAM Common Stock have been converted in connection with the Merger will receive whatever dividends are declared and paid on Telix Ordinary Shares. Notwithstanding the foregoing, any determination to pay cash dividends subsequent to the Merger will be at the discretion of the Telix Board and will depend upon a number of factors, including Telix’s results of operations, financial condition, future prospects, contractual restrictions, restrictions imposed by applicable law and other factors the Telix Board deems relevant. There can be no assurance that any future dividends will be declared or paid by Telix or as to the amount or timing of those dividends, if any.

Telix has never declared or paid any cash dividends on shares of Telix Ordinary Shares. Telix anticipates that it will retain its future earnings, if any, to finance the development of Telix’s business and does not anticipate paying cash dividends in the foreseeable future.

| 10 |

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

Statements contained in this Information Statement and the documents incorporated by reference herein that are not strictly historical may be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Exchange Act and involve a number of risks and uncertainties. There are a number of important factors that could cause actual events to differ materially from those suggested or indicated by such forward-looking statements, many of which are outside of the control of Telix and QSAM, and you should not place undue reliance on any such forward-looking statements. These factors include risks and uncertainties related to, among other things:

| ● | the uncertain value of the Closing Consideration that QSAM stockholders will receive in the Merger; | |

| ● | the inability to close the Merger in a timely manner; | |

| ● | the inability of the parties to complete the Merger due to the failure to satisfy other conditions of Closing; | |

| ● | the failure of the Merger to close for any other reason; | |

| ● | the contractual restrictions imposed by the Merger Agreement; | |

| ● | the possibility that the integration of QSAM’s business and operations with those of Telix may be more difficult and/or take longer than anticipated, may be more costly than anticipated and may have unanticipated adverse results relating to Telix’s existing businesses; | |

| ● | diversion of management’s attention from ongoing business concerns; | |

| ● | restrictions in the Merger Agreement that may discourage other companies from trying to acquire QSAM; | |

| ● | the effect of any litigation relating to the Merger; | |

| ● | risks related to CVRs, including the difficulty of valuing the CVRs and the wide variety of factors affecting the value of CVRs, transfer restrictions on CVRs, and the uncertain tax treatment of CVRs; | |

| ● | the potential changes in the relative values of Telix and QSAM subsequent to the delivery of the fairness opinion related to the Merger; | |

| ● | potential termination of the Merger by either party upon failure of the Merger to timely close; | |

| ● | the effect of the Merger on Telix’s stock price; | |

| ● | other factors that may affect future results of the combined company described in the section titled “Risk Factors” beginning on page 12 and in QSAM’s filings with the SEC that are available on the SEC’s web site located at www.sec.gov, including the sections entitled “Risk Factors” in QSAM’s Annual Report on Form 10-K for the fiscal year ended 2023; and | |

| ● | the risks set forth into this Information Statement, including the risks set forth in the section titled “Risk Factors” beginning on page 12. |

The forward-looking statements made herein speak only as of the date hereof and QSAM or any of its affiliates assumes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events and developments or otherwise, except as required by law.

| 11 |

In addition to the other information included in, or incorporated by reference into, this Information Statement, including the matters addressed in the section titled “Cautionary Statement Concerning Forward-Looking Statements” beginning on page 11 and QSAM’s Annual Report on Form 10-K for the year ended December 31, 2023 as filed with the SEC, you should carefully consider the following risk factors. This summary of risks is not exhaustive. New risks may emerge from time to time and it is not possible to predict all risk factors, nor can QSAM or Telix assess the impact of all factors on the Merger and the combined company following the Merger or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in or implied by any forward-looking statements. Please also see “Where You Can Find More Information” beginning on page 129.

Risks Related to the Merger

The number of shares of Telix Ordinary Shares that QSAM stockholders will receive as stock consideration is based on a fixed aggregate purchase price and will not be adjusted in the event of any change in the price of either Telix Ordinary Shares or QSAM Common Stock. Because the market price of Telix Ordinary Shares will fluctuate, QSAM stockholders cannot be certain of the value of the stock consideration that they will receive at the Closing in the Merger.

At the First Effective Time, each share of QSAM Common Stock (other than shares held by the Buyer, Telix, Merger Subs, QSAM or their respective direct or indirect wholly owned subsidiaries) issued and outstanding immediately prior to the First Effective Time, will be automatically entitled to receive stock or cash consideration in connection with the Merger or Reverse Split and one CVR for every share held pre-Reverse Split, which CVR will represent the right to receive the Earnout Consideration upon the achievement of certain milestones, if and to the extent achieved. See “The Merger Agreement—Merger Consideration” beginning on page 44. The formula to calculate the number of Telix Ordinary Shares is based on the Buyer Stock Price. This price was fixed as of the date of the Merger Agreement and will not change based on fluctuation in the price of Telix Ordinary Shares between the date of Merger Agreement and Closing. As a result, the actual market value of Telix Ordinary Shares may be lower than the Buyer Stock Price at the time of Closing. You should consider that if the market price of Telix Ordinary Shares declines between the date the Merger Agreement and the Closing, including for any of the reasons described below, QSAM stockholders will receive overall less value in stock consideration than expected. Further, the Telix Ordinary Shares are restricted securities and may not be sold immediately at Closing. Accordingly, there is no certainty that the shares will be trading at a price equal to or higher than the Buyer Stock Price at the time of QSAM stockholders are able to sell their Telix Ordinary Shares. In other words, if the value of Telix Ordinary Shares drops on or after the date of Closing, QSAM stockholders may not realize the expected gains.

Stock price changes may result from a variety of factors (many of which are beyond the control of Telix and QSAM), including the following:

| ● | market reaction to the announcement of the Merger and Telix’s prospects following the Closing; | |

| ● | changes in the respective businesses, operations, assets, liabilities, financial positions and prospects of Telix and QSAM or in market assessments thereof; | |

| ● | changes in the operating performance of Telix, QSAM or similar companies; | |

| ● | changes in market valuations of similar companies; |

| 12 |

| ● | interest rates, general market and economic conditions; | |

| ● | federal, state and local legislation, governmental regulation and legal developments relevant to the businesses that Telix and QSAM operate; | |

| ● | changes that affect Telix’s and QSAM’s industry, the U.S. or global economy, or capital, financial or securities markets generally; and | |

| ● | other factors beyond the control of either Telix or QSAM, including those described or referred to elsewhere in this “Risk Factors” section. |

Total Closing Consideration may be lower if indebtedness or number of QSAM shares outstanding is higher.

The amount of cash and/or shares of Telix Ordinary Shares payable with respect to each outstanding share of QSAM Common Stock as of the date hereof is subject to adjustment prior to closing based on, among other things, (i) the amount of indebtedness, unpaid expenses, change-of-control, and similar payments, in each case in connection with the Merger, as well as (ii) the fully diluted number of shares of QSAM common stock issued and outstanding as of the date of closing of the Merger, which could increase if certain stock options are exercised or other reasons. As a result, the amount of Closing Consideration payable with respect to each outstanding share of QSAM Common Stock could be lower on the date of Closing than was previously estimated as of the date of the Merger Agreement and as of the date of this Information Statement. For illustration purposes only, if indebtedness, expenses or other payables at closing is $500,000 greater than the current estimate of $3.62 million, then the value payable at the closing of the Merger and/or in the Reverse Split with respect to each share of QSAM Common Stock that is outstanding prior to the Reverse Split would be approximately $6.52, which would equate to 0.861 Telix Ordinary Shares for each whole share of QSAM Common Stock prior to giving effect to the Reverse Split. Similarly, if the outstanding shares of QSAM Common Stock are greater by 100,000 shares at the time of Closing due to exercise of stock options, the value payable at the closing of the Merger and/or in the Reverse Split with respect to each share of QSAM Common Stock that is outstanding prior to the Reverse Split would be approximately $6.49, which would equate to 0.856 Telix Ordinary Shares for each whole share of QSAM Common Stock prior to giving effect to the Reverse Split.

Your Telix Ordinary Shares will be “restricted securities” and will not be available for sale for at least a period of one year under Rule 144 of the U.S. Securities Act unless Telix chooses to become a reporting company under U.S. securities law, which is not guaranteed.

As indicated elsewhere in this Information Statement, Telix Ordinary Shares are being issued to QSAM stockholders pursuant to a private placement exemption from registration set forth in section 4(a)(2) and Regulation D of the Securities Act. Shares issued in private placements are considered “restricted securities” as that term is defined under Rule 144 of the Securities Act and may not be sold except pursuant to registration or an exemption from registration. However, a shareholder may sell “restricted securities” utilizing the safe harbor conditions of Rule 144. Typically, under Rule 144, a person that is not an affiliate of the issuer (Telix being the issuer) at the time of, or at any time during the three months preceding, a sale and who has beneficially owned restricted securities within the meaning of Rule 144 for at least six (6) months, may sell shares subject only to the availability of current public information about the issuer, and any such person who has beneficially owned restricted shares of issuer’s common stock for at least one year may sell shares without restriction; provided that the issuer is a public reporting company under the Exchange Act. Since Telix is not a public reporting company under the Exchange Act in the United States, the holding period for its restricted securities is currently one year. While Telix has publicly disclosed its intention of becoming a reporting company in the United States, there is no guarantee that will happen within the six months following the closing of the Merger, or at all. As such, while the Telix Ordinary Shares have a market in Australia, due to their restricted nature under the United States securities laws, they are not available for sale and there will be no liquidity to QSAM stockholders until the shares become eligible for sale or alternatively are registered for sale. We cannot guarantee that the stock price of Telix Ordinary Shares will be higher than the value attributable to them at the time of Closing, and if the price declines, QSAM stockholders may not realize the expected gains.

| 13 |

The market price of Telix Ordinary Shares may decline as a result of or following the completion of the Merger.

The market price of Telix Ordinary Shares may decline as a result of the completion of the Merger for a number of reasons, including if the Merger is viewed as an unsuitable investment by financial and industry analysts or by Telix shareholders, or if the effect of the Merger on Telix’s financial results is not consistent with market expectations. In addition, if the Merger is consummated, Telix stockholders, including the former QSAM stockholders, will own interests in a company operating an expanded business with a different mix of assets, risks and liabilities. Current stockholders of Telix and former QSAM stockholders may not wish to continue to invest in Telix, or for other reasons may wish to dispose of some or all of their shares of Telix Ordinary Shares. Further, Telix’s share price may decline independent of the Merger due to adverse changes in its business operations, product regulatory approval or commercialization of Telix’s products, or market conditions. Further, while QSAM’s stockholders cannot sell their Telix Ordinary Shares for an extended period post-Closing due to lock-up and restrictions under Rule 144, if, following the consummation of the Merger, there is selling pressure on Telix Ordinary Shares that exceeds demand at the market price, the price of Telix Ordinary Shares could decline.

The consummation of the Merger is subject to a number of conditions, and if these conditions are not satisfied or waived on a timely basis, the Merger Agreement may be terminated and the Merger may not be completed.

The Merger is subject to certain closing conditions set forth in the Merger Agreement, including: (i) the Reverse Split is effected; (ii) no more than two (2%) of the stockholders have exercised their dissenters’ rights in connection with the Merger; (iii) no more than 27 company stockholders are not “accredited investors”; and (iv) the absence of any law or order of any governmental authority of competent jurisdiction that enjoins, prohibits or makes illegal the consummation of the Merger. In addition, each of Telix’s and QSAM’s obligations to complete the Merger is subject to certain other conditions, such as (a) the accuracy of the representations and warranties of the other party, subject to the standards set forth in the Merger Agreement; (b) compliance by the other party with its covenants in all material respects; and (c) the absence of a material adverse effect on QSAM. See “The Merger Agreement—Conditions to Completion of the Merger” beginning on page 51. The failure to satisfy all of the required conditions could delay the completion of the Merger by a significant period of time or prevent it from occurring. Any delay in completing the Merger could cause the parties to not realize some or all of the benefits that are expected to be achieved if the Merger is successfully completed within the expected timeframe. There can be no assurance that the conditions to closing of the Merger will be satisfied or waived or that the Merger will be completed.

Failure to complete the Merger would adversely affect the stock price, future business and financial results of QSAM.

There can be no assurance that the conditions to the Closing will be satisfied or waived or that the Merger will be completed. If the Merger is not completed, the ongoing business of QSAM would be adversely affected and QSAM will be subject to a variety of risks and possible consequences associated with the failure to complete the Merger, including the following:

| ● | upon termination of the Merger Agreement, the $2 million option and collaboration fee paid by Telix to the Company upon execution of the term sheet for Telix’s acquisition of QSAM will convert into shares of QSAM Common Stock at a price of $6.70 per share, which could have a dilutive effect; | |

| ● | QSAM will incur certain significant transaction costs, including legal, accounting, financial advisor, filing, printing and mailing fees, regardless of whether the Merger closes; |

| 14 |

| ● | under the Merger Agreement, QSAM is subject to certain restrictions on the conduct of its business prior to the Closing, which may adversely affect its ability to execute certain of its business strategies; | |

| ● | QSAM may lose key employees during the period in which QSAM and Telix are pursuing the Merger, which may adversely affect QSAM in the future if it is not able to hire and retain qualified personnel to replace departing employees; and | |

| ● | the proposed Merger, whether or not it closes, will divert the attention of certain management and other key employees of QSAM from ongoing business activities, including the pursuit of other opportunities that could be beneficial to QSAM as an independent company. |

If the Merger is not completed, these risks could materially affect the business and financial results of QSAM and its stock price, including to the extent that the current market price of QSAM Common Stock is positively affected by a market assumption that the Merger will be completed.

QSAM will need additional capital to meet its current obligations and continue to operate its business if the Merger is not completed in a timely fashion or at all.

QSAM’s management has indicated that if QSAM had adequate funding in a timely manner, it may be able to complete its current Phase 1 safety trial of approximately 17 patients in 2024. Management has estimated that an additional $3 million to $4 million will be required to complete this phase of its study. The next step in QSAM’s clinical trial program, if cleared by the FDA, is expected to be a study designed to show both safety and efficacy in the treatment of bone tumors utilizing a multi-dose regimen of CycloSam®. Management estimates that an additional $12 million to $14 million will be required to complete the first portion of this critical phase of the study over the next 24 to 30 months.

Advancement of current and future plans for our technology requires significant additional funding, which would most likely result in the issuance of more common stock, preferred stock or debt in subsequent raises. There is no guaranty that we would be successful in raising such funding on terms acceptable to our shareholders, if at all, and if we were not successful, we may be required to slow down or cease our clinical trials, or in a worst-case scenario, shut down the Company. Our independent registered public accounting firm has issued a going concern opinion for the year ended December 31, 2023. This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next 12 months. Management expects expenses to increase in 2024 as our drug technology advances through clinical trials, and as a result, we will need to raise significant additional capital to support these operations. There is no assurance, however, that the Company will be successful in raising the needed capital and, if funding is available, that it will be available on terms acceptable to the Company. Any funds raised will likely result in material dilution to our current shareholders (in addition to dilution caused by conversion of the Option Payment (defined below in this Information Statement) to shares of Common Stock) or be in the form of debt which poses other risks of default. Our current cash or cash equivalents can enable us to fund our operations through the second quarter of 2024. If we are not successful in completing this Merger prior to June 30, 2024, or raising additional capital, or providing other options to support operations and our trials, we may need to delay clinical trials, reduce overhead, or in the most extreme scenario, shut down operations.

While the Merger is pending, QSAM will be subject to business uncertainties and certain contractual restrictions that could adversely affect the business and operations of QSAM.

In connection with the pending Merger, some operators, managers, suppliers, vendors or other third parties of QSAM may react unfavorably, delay or defer decisions concerning their business relationships or transactions with QSAM, which could adversely affect the clinical stages of QSAM, regardless of whether the Merger is completed. In addition, due to certain restrictions in the Merger Agreement on the conduct of business prior to completing the Merger, QSAM may be unable (without Telix’s prior written consent), during the pendency of the Merger, to pursue strategic transactions, undertake significant capital projects, undertake certain financing transactions and otherwise pursue other actions, even if such actions would prove beneficial and may cause QSAM to forego certain opportunities it might otherwise pursue. In addition, the pendency of the Merger may make it more difficult for QSAM to effectively retain and incentivize key personnel and may cause distractions from QSAM’s strategy and day-to-day operations for its current employees and management.

| 15 |

QSAM will incur substantial transaction fees and Merger-related costs in connection with the Merger.

QSAM expects to incur non-recurring transaction fees, which include legal and advisory fees and substantial Merger-related costs associated with completing the Merger. These fees will be payable by QSAM even if the Merger does not close, and therefore, will impose a significant financial burden on QSAM which would materially impair its ability to continue operations in the instance the Merger is terminated. Further, QSAM will continue to bear the costs and expenses of its operations prior to the Closing, and any delays in the anticipated closing date will result in additional indebtedness and/or payables existing at Closing which QSAM may not have the available cash resources to pay. In this instance, Telix would have the right to reduce the Closing Consideration payable to the QSAM stockholders in the amount of any additional indebtedness that it is required to pay or assume.

QSAM stockholders will have a substantially smaller ownership and voting interest in Telix upon completion of the Merger compared to their ownership and voting interest in QSAM prior to the Merger.

Upon completion of the Merger, each QSAM stockholder at the First Effective Time will become a Telix stockholder with a percentage ownership of Telix that is substantially smaller than the QSAM stockholder’s current percentage ownership of QSAM. Upon completion of the Merger, based on the number of shares of Telix Ordinary Shares and QSAM Common Stock outstanding on March 31, 2024, the latest practicable date prior to the filing of this Information Statement, it is estimated that continuing Telix stockholders will own greater than 98% of the issued and outstanding ordinary shares of Telix, and former QSAM stockholders will collectively own less than 2% of the issued and outstanding ordinary shares of Telix. Accordingly, the former QSAM stockholders will exercise significantly less influence over Telix after the Merger relative to their influence over QSAM prior to the Merger, and thus will have a less significant impact on the approval or rejection of future Telix proposals submitted to a Telix stockholder vote.

Litigation against QSAM, Telix or the members of their respective boards could prevent or delay the completion of the Merger or result in the payment of damages following completion of the Merger.